The forecast from the company ForexMart (ForeksMart)

Forecast USD / JPY for the week 23-27 January

Currency pair USD / JPY during the last week corrected to line 113.00, the 38.2 Fibonacci retracement area of the upward trend that began after the victory of Donald Trump in the presidential race. The pair then went back to 114.50, where the simple moving average of the last 100 trading weeks, which means the current search market equilibrium and a new direction, which is more likely to determine the future steps of the new US president. Technically, the pair is ready to continue the ascent, but the fundamentals are at the moment the market may expand in any direction. Next week promises to be busy and set a course for the medium term movement of the pair.

Forecast USD / CHF for the week 23-27 January

Currency pair USD / CHF for the current week showed a slight decrease, forming a reversal pattern "head and shoulders" on the daily chart. At the time of writing, the pair is trading near the prognosis resistance line of 1.0050, but the main fight after the inauguration of the new US president will unfold over the parity line. If the pair consolidates her, it is likely we are waiting for the formation of the downward trend, if the pair rises above the moving average 50 days - waiting for re-occurrence of the bulls. The momentum begun at the end of Friday's trading is likely to develop following week.

Forecast GBP / USD on the week 23-27 January

Today the attention of market participants aimed at the US and the US President's inauguration. If Donald Trump will pronounce any speech at the weekend, most of all it will affect the pound. This week, poor data from the UK did not have any impact on the pair due to strong pressure from the Brexit. Forecast suggests sideways within the range of 1,21-1,24. If the pair manages to consolidate above the level of 1.24, it is the couple can leave to 1.30.

Forecast USD / CAD for the week 23-27 January

A pair of American / Canadian Dollar moves within the ensuing sharp upward rising channel. The purpose of continuing growth region is higher than 1.3550, which after overcoming possible quotes growth above the level of 1.38. Opposition option would be the fall of the pair and a break area near 1.2970, which again form a further downward trend.

Important news from Canada are expected next week. In the meantime, the markets are waiting for the results of the first consequences and the inauguration of Trump. Intention of the new US president to revise the agreement on the North American Free Trade Agreement (NAFTA) cooled the ardor of "bulls" and a pair of long holds its position near the mark 1.3348.

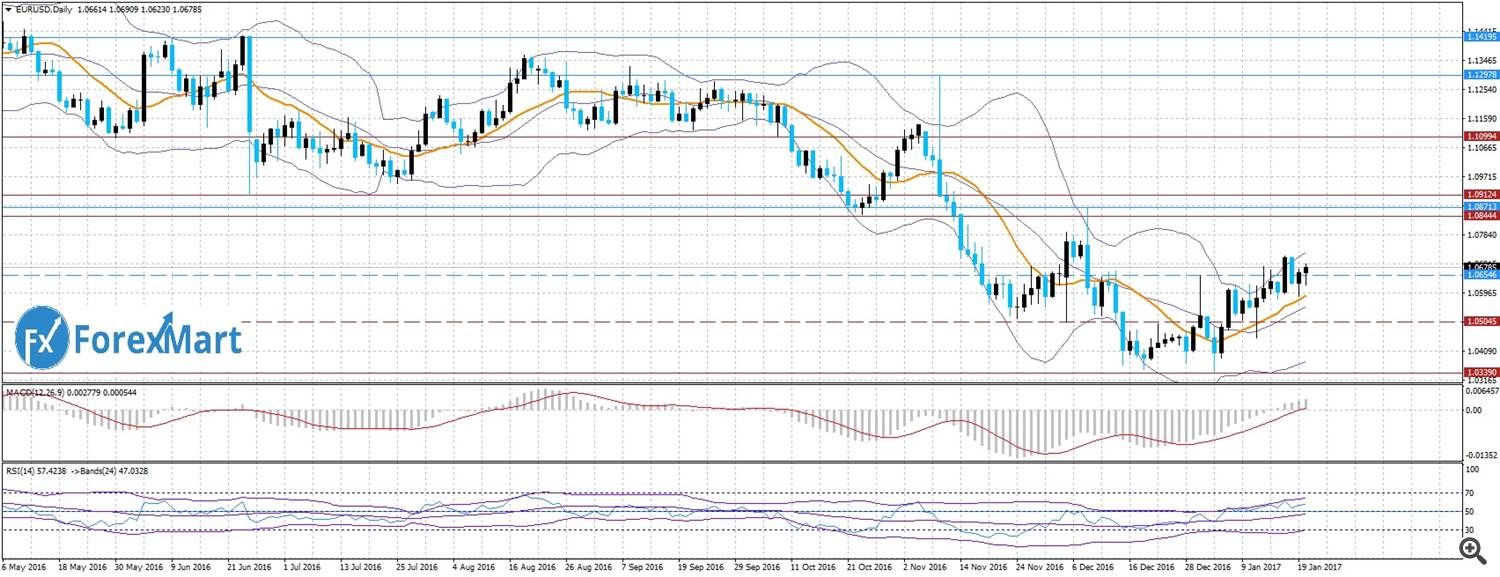

The forecast EUR / USD on 23-27 January

Today, a major event for the dollar will be the inauguration of US President Donald Trump. Euro as expected in the forecast for this week, could not be fixed above the level of 1.07, and adjusted downward. RSI is still in the neutral zone, and where to move the price is unknown, as the background voice of Donald Trump's price can go both up and down. Most likely, the pair will go to the level of 1.05.

Forecast USD / RUB at week 23-27 January

Ruble continues its fluctuations against the background of changes in oil prices. The cost of "black gold" is growing as a result of compliance with OPEC and the OPEC + agreement. There are likely to achieve the threshold of $ 60 per barrel. At that price the oil vapor USD / RUB can safely apply to the location near the level of 56-57 rubles per dollar.

As long as the pair continues to move within the boundaries of the range below 60 rubles. The RSI indicator was located above the level of support, can support a retest, or bounce up in the neutral zone. Thus, the most probable forecast for the coming week - a fall in the dollar to the area 58.00 - 58.50 in the case of rebound down from 60 rubles. An alternative option would be a correction in the region of 62 rubles.

Related posts

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) EUR / USD. 11.04. The pair will continue to trade sideways Yesterday, the euro / US dollar resulted in...

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) 13.07. fundamental analysis The focus today: The index of producer prices in the US Speech by US Federal...

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) GBP / USD. 18.01. The pound rose, but the situation is still ambiguous Yesterday the pair showed...

Next posts

- Analyst from company ForexMart

- Currency purchases in August Finance

- US dollar falls in Asian trading

No comments:

Post a Comment