Tax reform Trump will be an indicator of movement of global markets

Global markets now expect the US president's speech Donald Trama, in which he reveals his plans for tax reform. Depending on what it will offer, or it can ensure the growth of markets, or to become a major disappointment.

Asian markets are growing in the hope of tax reform in the US

Asian indices are growing

Shares rose in Asia amid hopes of tax cuts that the US president Donald Trump is to announce today, as part of a future tax reform. This has led to an increase in the vast majority of Asian background indices.

Japanese index Nikkei 225 jumped 1.04% to 19 277.50, Hong Kong Hang Seng index rose to 24 550.00 (+ 0.38%), South Korean Kospi reached 2 207.84 (+ 0.50%), and Chinese Shanghai Composite up 0.2% to 3 140.85.

Australian S P / ASX 200 rose to 5 912,04 (+ 0,69%), Topix rose by 1.2% to 1 537.41 and JPX-Nikkei Index 400 - 1.23% to 13 763.69.

Tax reform in the US

President Donald Trump plans to publish today the details of the tax reform. Investors expect that the tax cuts will improve the profitability of US companies and will encourage the growth of consumer spending.

European markets retreated from record highs

Negative corporate data in the euro zone

Shares of European companies slightly retreated from 20-month high at the beginning of today's trading on the background of rather negative corporate data.

By 11:40 MSK-European STOXX 600 index lost 0.02%, down to 386.85. German DAX decreased by 0.02% and dropped to 12 465,00, French CAC 40 grew only 0.01% to 5 278.50, and the British FTSE 100 has fallen to 7 274,50 (-0.02%) .

European stocks

Continuing a generally positive mood of the market, which on the eve raised the stock to record highs, receded into the background, as earnings reports of European companies have become the main driver of traffic.

Best results today was led by the French group Kering companies with growth of 10%. Outsider environment has become a group of companies for the production of BIC stationery products (-12%).

The American market has shown impressive growth

Economic Releases inspired market

The stock market in the US was closed on Tuesday on a positive note with a significant increase in all major indices. The most impressive results are seen in the technology and energy sectors, as well as in the health sector and among telecommunications companies.

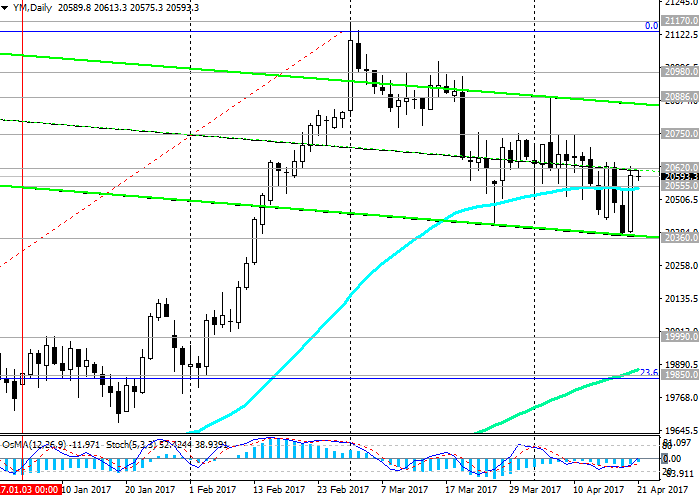

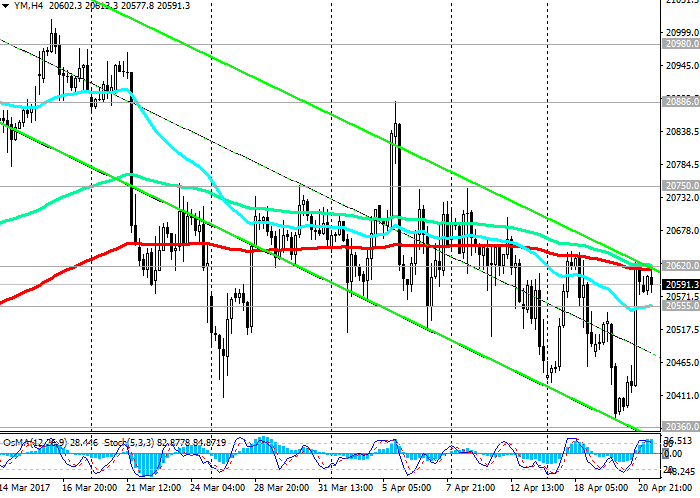

Yesterday's trading Dow Jones Industrial Average finished at around 20 996.12 increasing by 1,12%, Nasdaq composite increased by 0.7% to 6 025.49 and S P 500 added 0.61% to 2 388.61.

US Macroeconomics

The markets were encouraged by data on new home sales in March, which rose to 621,000 on an annualized basis compared to 587,000 in February. According to the Case-Shiller index of housing prices in the US rose in February by 5.9%, which indicates continued growth in the residential property sector. However, according to the Conference Board consumer confidence fell slightly in April.

What do you expect the market environment

Today, the market is waiting for the release of data on mortgage lending, performance Trump about the tax reform and the speech of the US Treasury Stephen Mnuchina.

European oil started the session lower

Oil supplies are growing in the US

Oil prices on Wednesday fell in European trading, while remaining close to a four-week low the previous session against the backdrop of an unexpected increase in supplies of raw materials in the United States.

As of 12:30 MSK July futures for Brent traded around $ 52.49 and WTI with delivery in June - at $ 49.47 per barrel.

report API

At the end of Tuesday, the American Petroleum Institute (API) issued a report that showed that crude oil inventories in the US for the week ended April 21, rose by 897,000 barrels to 532.5 million barrels. This suggests that OPEC plan to cut supplies, reduce inventory and price stabilization does not work.

Exit EIA report

Today is expected to publish a report on crude oil inventories from the Energy Information Agency (EIA), but may not be, it will be decisive in determining the future market movements. Data on stocks of gasoline and other petroleum products can play a crucial role. So, last week the growth of this particular indicator has led to decline in oil prices by almost 4%.

Gold remains under pressure

Traders lose interest in gold

Precious metal continues to feel pressure from the growing demand for higher-yielding assets, while the weak dollar has not yet affected by the current situation.

Gold futures for June delivery on the Comex rose by 0.17% to $ 1 267.20 per troy ounce. The price of spot gold was 1 264.93 (+ 0.09%).

Silver has risen in price by 0.03% to $ 17.57, platinum fell by 0.07% to $ 956.90, while palladium is added to the price of 0.31% to $ 800.75.

Sources of influence on the gold market

The results of the first round of the French presidential election and the absence of threats that preceded the first round, also affect the price of gold. In the absence of geopolitical surprises on the price of gold will continue to continue to decline.

Related posts

Shares of ATP on Thursday turned

Shares of ATP on Thursday turned to growth after the Chinese rebound Today markets The Asia-Pacific region mainly grown. Chinese stock market found...

Larri Vilyams Training important

Larri Vilyams: Training - important in trading and running Trader and marathon runner Larri Vilyams (Larry Williams) It draws parallels between...

Daily Economic Digest from Forex

Daily Economic Digest from Forex.ee Daily Digest of economic Forex . ee Keep an eye on major economic news with us Wednesday, August 30 Couple EUR / USD...

Next posts

- Igor Shuvalov said release of

- Daily Economic Digest from Forex

- DJIA Steven Mnuchin cheered inve