DJIA: Steven Mnuchin cheered investors

US Treasury Secretary Steven Mnuchin during his yesterday

speech said that the tax reform plan will be "very, very soon."

This plan will be "decisive, essential, and will be the main priority for

President Trump. " After

Presidential elections in the United States against the backdrop of pre-election promises by Donald

Trump tax reform and stimulate fiscal policy US

stock markets and indices grew actively and government bonds were subject to

large-scale sales. Now in the US stock markets, the reverse

picture.

investors

still exerts pressure increasing geopolitical tensions in the world after

US missile strikes on Syria. The growing tension between the US and North

Korea also does not increase the appetite for buying riskier assets. investors

again prefer government bonds and other safe-haven assets - gold and the yen.

also common

picture spoil some of the negative macro data from the US. So, published

Yesterday the US Department of Labor data showed a reduction in the number of repeat applications

for unemployment benefits last week

and increase in the number of initial claims (244,000 versus 234,000 at

last week). Manufacturing Index, which is interconnected with

ISM index fell in April to 22 points (vs. 32.8 in March).

Nevertheless, the major US stock indexes

today, boosted by reports of companies, exceeding economists' expectations.

Dow Jones Industrial Average rose in

Thursday at 0.9% to 20582 points, S P500 - to 0,8%, Nasdaq Composite - 0.9%. The yield on 10-year-olds

US Treasury bonds on the background of their sales rose to 2.257% from 2.202%

on Wednesday, which also contributed to the strengthening of the dollar. US Treasury

Steven Mnuchin cheered investors by returning their hopes on the fact that Trump plan

to stimulate the US economy will still be implemented.

Today, there is little activity in the financial markets

traders on the eve of the first round of the presidential elections in France, which is

It will be held this Sunday. The risk

that the election results can disrupt the integrity of the EU, is still holding back

investors from taking action on the financial markets. If you win Marin Le

Pins, which promised to withdraw France from the EU, the euro and European stock

markets may literally collapse. Behind them may follow US stocks

markets. Dramatically increase the demand for gold and the yen.

From the news today is to provide data from the US. AT

13:45 (GMT) published indexes of business activity in the manufacturing sector,

services sector (PMI) released by the Markit US in April (preliminary value). Index

It is an important indicator of the state of the US economy as a whole. At 13:30 begins

the speech of the Federal Reserve Bank of Minneapolis Nile Kashkari, which is likely to be

follow in the wake of the general statements of other members of the Fed's relatively

monetary policy in the US and would vote in favor of an early rate hike

the US Federal Reserve and the reduction of the budget. This will reflect positively on the dollar, but it is unlikely

It supports US stocks.

Support and resistance levels

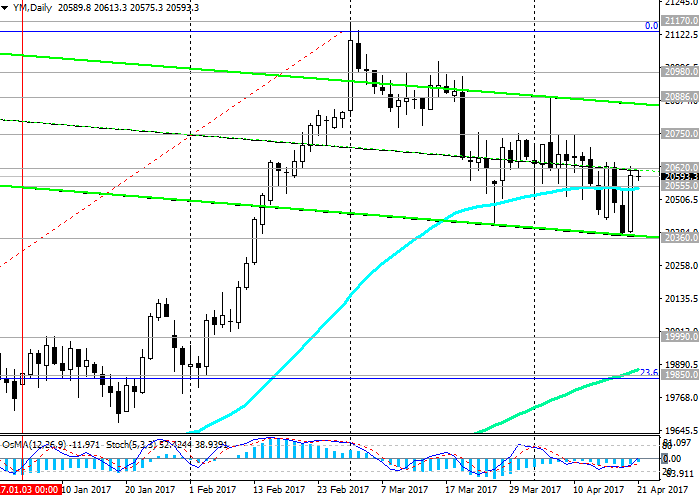

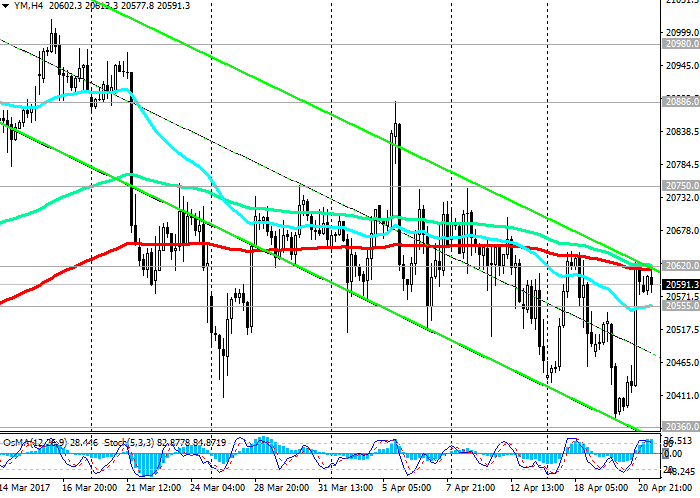

Since the beginning of the previous

month, the DJIA is mainly reduced. Since the end of February reached the absolute

maxima near the mark 21170.0 index DJIA lost about 3.5%, down to

the current level of 20600.0. However, after yesterday's statement by the Minister

US Treasury Stephen Mnuchina DJIA index rose, broke the short-term resistance level of 20555.0 (EMA200

at 1 hourly chart), however, resistance was suspended 20620.0 (top level

the boundary of the descending channel and EMA200 on 4-hour chart).

indicators

OsMA and Stochastic on the 1-hour, 4-hour chart

re-deployed on short positions.

If the index

DJIA will return to the level of 20555.0, its

reduction can proceed to the nearest support level of 20360.0 (lower

limit of the downward channel on the 4-hour and daily charts).

If

downward dynamics will continue to grow, then the index may continue to decline

support levels 1990.0 (the December highs), 19850.0 (Fibonacci level

23.6% correction to an increase in the wave with the level of 15660.0 after recovery in February

current year to a collapse of the markets since the beginning of the year. The maximum of the wave

and 0% Fibonacci level is near the level of 21160.0). Further reduction of the breakdown level and 19600.0

(EMA200 on the daily chart) will be

critical for the bullish trend the DJIA.

For

return to the index of purchases necessary to gain a foothold above the level of 20750.0 (top

border range between the levels 20750.0 and 20360.0). While dominated by short-term

descending correctional dynamics.

Support levels: 20555.0, 20360.0, 19990.0,

19850.0, 19600.0

Resistance Levels: 20620.0, 20750.0,

20886.0, 20980.0, 21170.0

Business scenario

Buy Stop 20650.0. Stop-Loss 20540.0. Take-Profit 20750.0,

20886.0, 20980.0, 21170.0, 22000.0

Sell Stop 20540.0. Stop-Loss 20650.0. Take-Profit 20360.0, 19990.0, 19850.0, 19600.0

Related posts

Forex ee Economic Daily Digest

Forex.ee: Economic Daily Digest Daily Digest of economic Forex . ee Keep an eye on major economic news with us Wednesday, May 25 EUR / USD He moved away...

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) 13.07. fundamental analysis The focus today: The index of producer prices in the US Speech by US Federal...

Forex ee Economic Daily Digest

Forex.ee: Economic Daily Digest Daily Digest of economic Forex . ee Keep an eye on major economic news with us Monday, 8 August GBP / USD current price:...

Next posts

- Finance Ministry prepares proposals

- ECB will continue to observe predominance

- Usdjpy could not continue recov

No comments:

Post a Comment