renko Charts

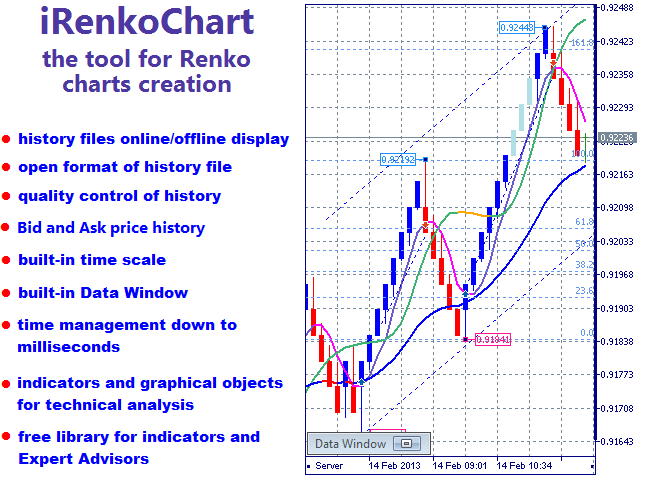

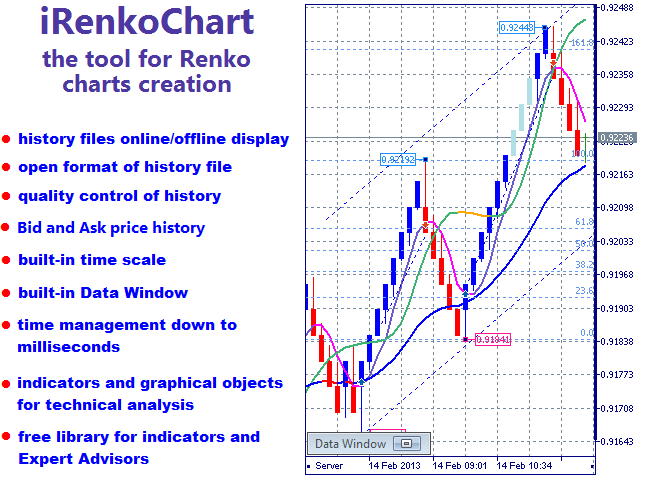

iRenkoChart indicator is designed to create a custom Renko charts. Used open format of history files, easy switching between the graphs based on the Bid and Ask quotes, quality control history, the use of experts, indicators and graphical objects for technical analysis and much more.

This indicator is based on the engine iCustomChart and is its particular implementation. ICustomChart demo version can be downloaded free of charge.

Content:

- Advantages and features

- Input parameters

- indicator buffers

- data window

- history files

- Quality control History

- Timeline

- Graphical objects for technical analysis

- Indicators and experts

1. Advantages and features

- starts and runs on any open chart window (hereinafter - the graphic substrate);

- after downloading looks like a normal chart (see screenshot);

- to get started is not required to have a pre-generated history files;

- used open format of history files;

- You can use the data format of MetaTrader 4, MetaTrader 5;

- easy switching between graphs based Bid or Ask quotations;

- quality control of history (see screenshot 7);

- full format's history, including the opening of the boxes (bars), spread, tick and stock volumes;

- has built-in data window (DataWindow) (see Screenshot 4);

- has built-in time scale (see screenshot 6);

- automatic scaling of the price scale;

- can use most of the objects from the standard set MetaTrader 5 (see screenshot 2) for technical analysis;

- the ability to display online- or offline-graphs;

- the ability to control the time of opening bars to the millisecond;

- you can write on the basis of the schedule iRenkoChart own indicators and advisers using free LibCustomChart library (see screenshot 3, 8).

2. Input Parameters

- Max bars in chart - It allows you to display a fixed number of bars (boxes) in the chart window. A zero value can display the maximum possible number of bars, up to a specified client terminal settings. When this parameter acts as a parameter similar client terminal described in the certificate. The default is 1000.

- Size of box - range or size (boxes) bars in points from the opening price (the open) to the closing price (close). The default is 200.

- Value of zero buffer - zero buffer value is calculated in accordance with the selected price constant.

3. Indicator buffers

Number indicator buffer

Content

|

0 |

It contains selected price constant. Buffer is mainly intended for data other indicators that use the first form of the call. |

1 |

bar opening time (boxing). |

2 |

The opening price of the bar. |

3 |

The maximum price of the bar. |

4 |

The minimum price of the bar. |

5 |

The closing price of the bar. |

6 |

Color bar. |

7 |

Exchange volume. |

8 |

Tick volume. |

9 |

Spread. |

4. Data Window

Built-in data window looks similar to regular window in the MetaTrader 5 data, but has a few additions (Screenshot 4). The data fields are displayed in the window:

- the top field - symbol and a parameter name. The - this bar point size (Size of box), specified in the input parameters of the indicator. When you click on this field to load a window with information about the history of the file (Screenshot 5).

- Date - bar opening date.

- Time - the opening of the bar.

- Open - the opening price of the bar.

- High - the maximum price of the bar.

- Low - the minimum price of the bar.

- Close - the closing price of the bar.

- Volume - exchange volume.

- Tick Volume - tick volume.

- Spread - Spread bars.

- Bar - bar number; Zero bar - the last unfinished bar.

The data window has several display control buttons Graphics:

- Shadows - button enables / disables the display of shadows on the keyboard keys duplicated "S";

- Update - button on / off mode, the update schedule (hotkey "U");

- Bid / Ask - button switch the display graphics based on the Bid or Ask Price (hot keys "B"And"A"Respectively);

- Open / Close - open / close data window button in the upper right corner of the data window (hotkey "W");

- Redraw - redrawing the graphic button is located next to the closing of the data window (hotkey "R").

Keyboard shortcuts only work with the active chart window.

5. History Files (HST-files)

To draw graphs using the open format of history files, described in the User Guide MetaTrader 4. You can get ready for Renko history file or create it yourself. You can then use iRenkoChart display for graphics.

The format of the history file is as follows. First there is the history of the file header:

struct HistoryHeader

{

int version // version of the database

char copyright [64]; // copyright

char symbol [12]; // tool

int parameter; // period or setting tool for iRenkoChart the value of the input parameter "Size of box"

int digits; // number of digits after the decimal point in the tool

time_t timesign; // temporary fingerprint database creation

time_t last_sync; // the last synchronization

int type; // type of stored history, 1 - Ask-story, 2 - Bid-story,

// any other value - kind of history is not defined

int unused [12]; // for future use

};

Please note that the new "type" parameter has been added to the standard header.

base version history files MetaTrader 4 indicates "400" for MetaTrader 5 - "500". This is important because each version has its own bar data structure.

Standard representation of an array of bars, following the headline for the story version of "400" is as follows:

#pragma pack (push, 1)

struct RateInfo

{

time_t ctm; // time in seconds

double open; // open price of the bar

double low; // the minimum price of the bar

double high; // maximum bar price

double close; // closing price bar

double vol; // volume

};

#pragma pack (pop)

Standard representation of an array of bars for the history file version of "500" is as follows:

#pragma pack (push, 1)

struct MqlRates

{

datetime time; // bar time in seconds or milliseconds

double open; // open price

double high; // the highest price for the period

double low; // lowest price for the period

double close; // close price

long tick_volume; // tick volume

int spread; // spread

long real_volume; // exchange volume

};

#pragma pack (pop)

Note that the version of "500" bar time can be specified in seconds, and milliseconds. iRenkoChart correctly identifies both of the time format.

Important: The responsibility for the correctness of the history of the file the user.

To iRenkoChart to recognize the history of the file, it must be in the folder "katalog_dannyh_terminala \ MQL5 \ Files \ iRenkoChart \ History \ imya_brokera". File name history

- It must begin with the "Renko" prefix. Before prefix may be added "Ask" or "Bid", if the file is stored in the appropriate type of stories;

- then the tool should indicate the name of the graph is an indicator substrate is loaded (e.g., "EURUSD");

- should go further value of the input parameter "Size of box" indicator;

- and must have the extension ".hst".

An example of the file name: AskRenkoEURUSD200.hst

If the history file does not exist, it will automatically be created from the minutes of history available in the terminal. If there is, then it will be updated in accordance with a built-in algorithm.

6. Quality control History

To file stories created exclusively iRenkoChart, possible to control the quality of the story.

Any new history file is created from minute stories available in the terminal. Accordingly, there may be situations where simulated bars may differ from the bars, created online. Each questionable modeled bar graph is displayed in a lighter color than the correct bars (screenshot 7). It allows you to visually assess the quality of the story.

When initializing the indicator or switch Bid and Ask stories in the magazine appears on its quality (Screenshot 7). It is possible to estimate the percentage of good and bad bars. Note that calculation history quality only for bars shown in the chart, not to the entire history of the file.

Also taken into account in the formation of history gaps. In the graph visually default gaps are displayed as bars in gray and zero volume.

Using the indicator buffer "color bar", you can program to assess the quality of the stories of their indicators and experts. This allows you to make appropriate decisions in the implementation of a particular trading strategy.

Improve the quality of stories by iRenkoChart only online. When you receive a tick data iRenkoChart correctly calculates all parameters of bars and stores them in the history file. For example, the opening of the bars will be calculated and written down to the millisecond. If the tick data to construct a history for some time have been reported (remote connection, disable the terminal or any emergency situation), the missing history Renko will be formed based on the minute.

7. Timeline

The time scale graphs created with iRenkoChart, usually does not coincide with the scale of the graph and the time the substrate is nonlinear. Therefore, in the indicator built own time scale for visualization (screenshot 6). Features built-in scale:

- It looks similar to the regular time scale;

- easily it moves vertically;

- It has a translucent background, always visible graphics and price chart for the scale.

8. Graphical objects for technical analysis

Standard graphics objects terminal attached to the timeline graph substrate when placing in the graph window. Therefore iRenkoChart automatically rebound overlay graphics to your timeline. This makes it possible to use standard graphics for technical analysis Renko charts. Synchronization with iRenkoChart supported for the following full-time graphical objects in the MetaTrader 5:

- lines: horizontal, vertical, trend, trend of the corner, cyclic, lines with arrows;

- Channels: equidistant, Andrews pitchfork;

- Fibonacci tools: line, time zones, fan, arcs, channel expansion;

- Instruments Elliott: impulse wave corrective wave;

- shapes: triangle, rectangle, ellipse;

- arrow: good, bad, down, up, stop, tick, left and right price tag, the icon "Buy" and "Sell", custom arrow.

Sometimes, such as when closing the terminal, iRenkoChart stores data about the objects in a temporary file, which is located in the folder "katalog_dannyh_terminala \ MQL5 \ Files \ iRenkoChart \ Objects". all temporary files are also deleted when you delete iRenkoChart of the chart window.

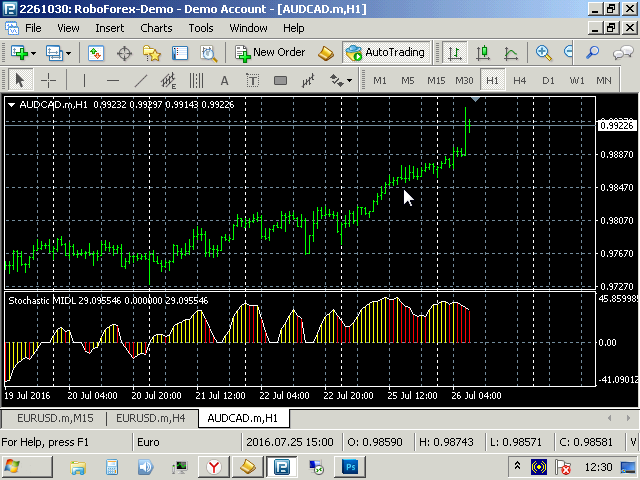

9. Indicators and experts

Conventional indicators, as well as objects, follow the timeline graph substrate. To bind to the timeline indicator iRenkoChart recommended to use the free LibCustomChart library.

library functions allow you to write indicators that automatically connect to iRenkoChart (Screenshot 3), if it is loaded in the graphics window. If not loaded, these indicators will be no problem to work in a normal chart window. In addition, the library provides simplified access to Timeseries iRenkoChart.

If the library functions used in the expert, the expert, as well as the indicator will automatically use iRenkoChart data if it is already loaded in the graphics window. If iRenkoChart not loaded, the expert will work in the usual chart window and use the data.

Examples of the use of the library in the indicators and experts can be found in Code Base.

This indicator is based on the engine iCustomChart and is its particular implementation. ICustomChart demo version can be downloaded free of charge.

Related posts

Herrick Payoff Index

Herrick Payoff Index payment index Herrick (Herrick Payoff Index, HPI) confirms the strong trends and helps determine when they change its direction;...

Kagi Chart

kagi Chart Kagi Chart indicator can display graphics "Kagi" in the indicator window. Graphics Type "Kagi" filters out unwanted noise and help identify...

Trajecta Smart

Trajecta Smart Trajecta Smart - an innovative semi-automatic trading signals indicator for each pair and timeframe, which has a built-in system to...

Next posts