Fundamental Forex Analysis

Forex fundamental analysis of the market - is forecast in the currency markets. The essence of this analysis - to examine, for whatever reason, the price has changed. In the currency market, a lot of traders who prefer this type of analysis.

This analysis examines the events that affect the country's national currency. Of course, to respond to what is happening in the world of events is impossible, the Forex market turns its attention only on the major and key events in politics and economy.

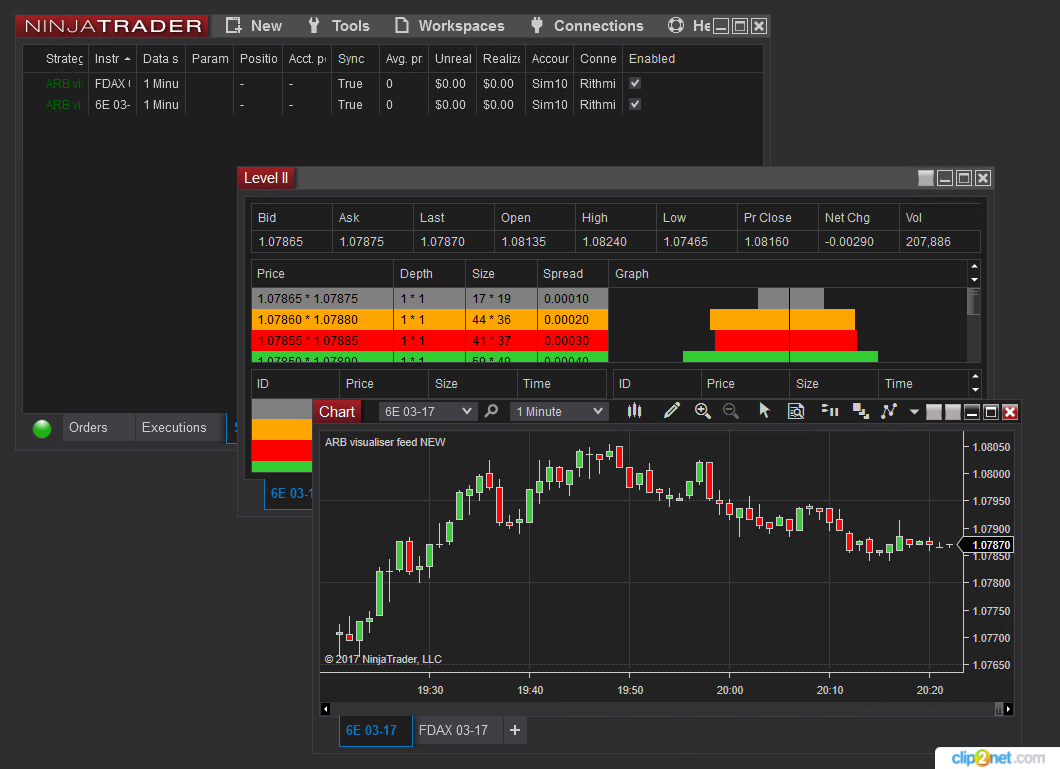

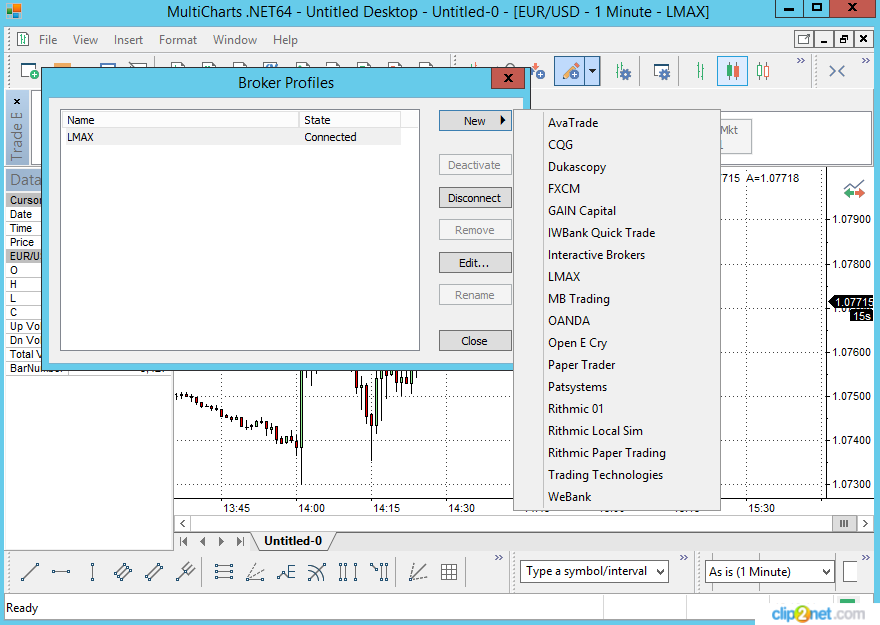

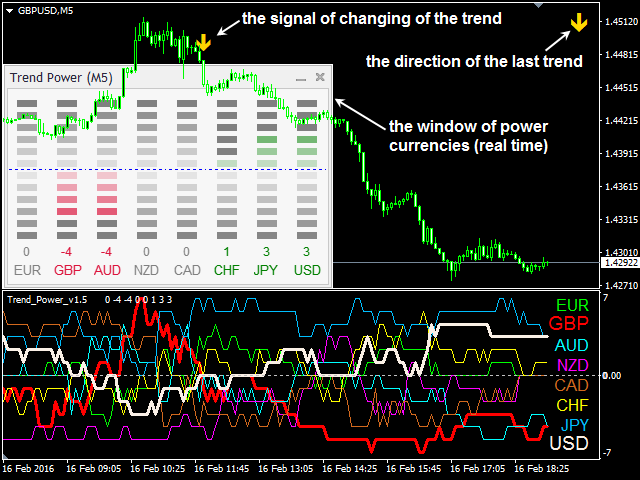

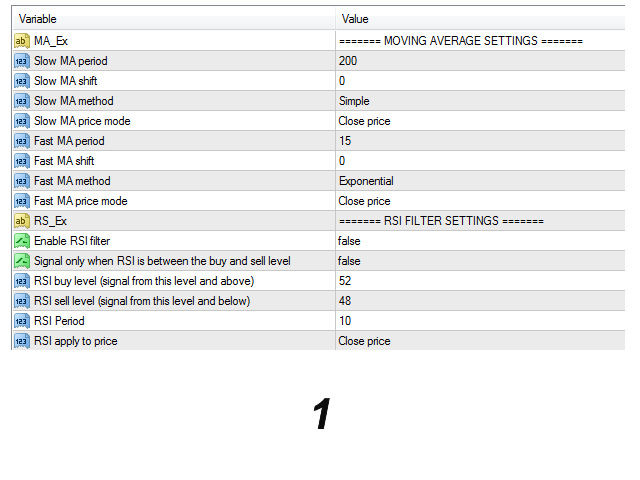

New technologies greatly simplify the life of traders. Today, they do not sit for hours, carrying out search and analysis of information on the foreign exchange market, because all the necessary information is supplied to the terminal automatically.

What are they key events?

Fundamental events that have an impact on the market, divided into predictable and unpredictable. By unpredictable events include a sharp change of power, natural disasters and other force majeure. Such a situation is impossible to predict. Do you agree?

For predictable events are periodically exiting news and statistics. Waiting for news, market participants plan their actions in advance, and after the air - operate. To forecast the news include macroeconomic data of countries.

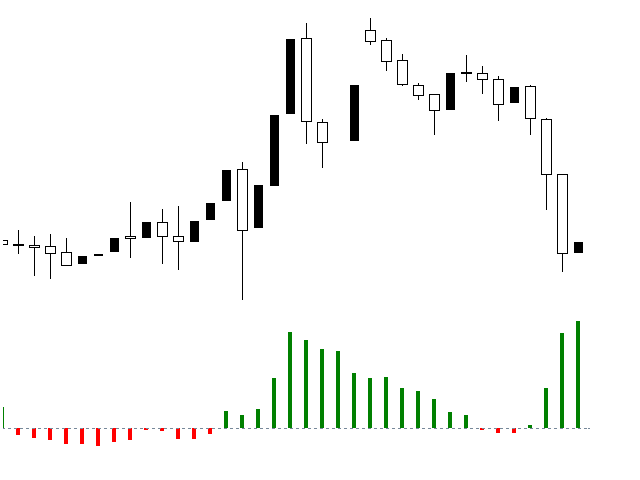

All factors that are part of the fundamental forex analysis, divided into classes depending on how long the news affect the marketplace. There are factors that are called short-term. These include news that long can affect the market exchange rate. With their help it conclude the deal quickly.

News, whose long life, exert their influence on the market a few days or even up to several years. Among such news - the economy, the level of US debt, unemployment and so on. Using these factors, traders enter into long-term deals.

Chief Trader Assistant - economic calendar. It is here that the most important news that influence the currency market.

Fundamental analysis is quite complex and all its complexity that any events each trader understands in his own way. This analysis is related to the psychology of the forex market, and in this regard, what is happening is relatively difficult to understand and often cause unpredictable reactions of market participants.

In order to grasp the essence and method of work with the help of this analysis, first of all, you need to grasp the theoretical basis. To do this, you need to read as much as you can about the Forex market information. Only after you understand the basics of fundamental analysis of the Forex market, you find out what events are and how strong an impact on the market, open a demo account, test your knowledge and watch for changes.

Related posts

Gold Trading Forex

Gold Trading Forex. In spite of their belonging to the precious metals gold is also the subject of intense speculation in the forex market . gold on the...

Daily Economic Digest from Forex

Daily Economic Digest from Forex.ee Daily Digest of economic Forex . ee Keep an eye on major economic news with us Monday, February 20 Euro today made...

Auxiliary forex tools

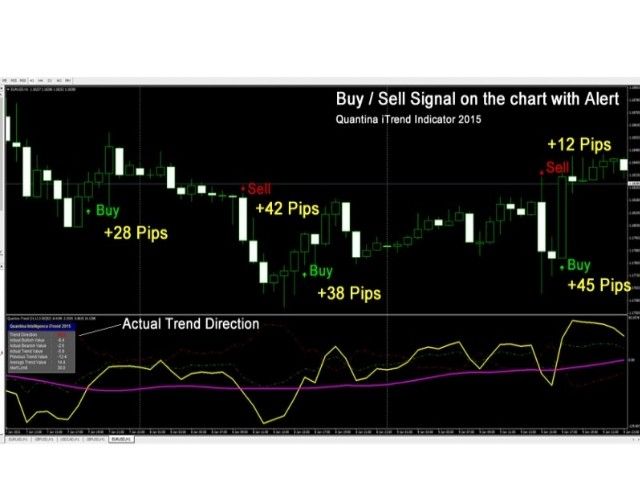

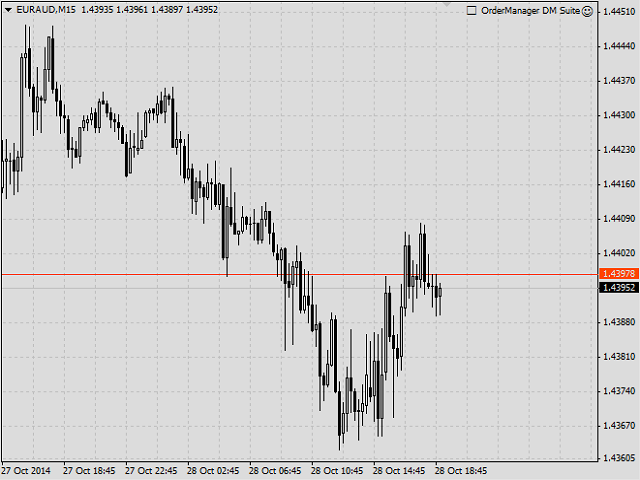

Auxiliary forex tools. Trade on any of the exchanges is a pretty difficult task, so why not make it a little easier for these purposes, various forex...

Next posts

- Multicharts NET and NinjaTrader

- Report for Investors

- Daily Economic Digest from Forex