German stock market closed mixed, DAX 30 added 0.26%

© Reuters.

German stock market closed mixed, DAX 30 added 0.26%

Investing.com - German stock market closed trading Friday in different directions due to the strengthening of public services sectors, retail and insurance. Market shows against the background of negative dynamics from the food and beverage sectors, pharmaceuticals and media.

At the close of the Frankfurt Stock Exchange DAX 30 rose by 0.26%, reaching a 52-week high, MDAX index rose by 0.19%, the TecDAX index dropped by 0.08%.

The leaders of growth were the shares of Adidas AG (DE: ADSGN) among DAX 30 index components on the basis of today's trading, which rose to 2,200 p (1.49%), closing at 150,150.. Quotes RWE AG (DE: RWEG) increased by 0,125 p (1.07%), ending trading at 11.815.. Paper Deutsche Bank AG (DE: DBKGn) rose to 0.140 p (0.82%) to close at 17,250..

Leaders of falling were shares of Fresenius Medical Care AG Co (DE: FMEG), the price of which has fallen to 1,130 p (1.39%), ending the session at around 80.450.. Shares of Deutsche Lufthansa AG (DE: LHAG) rose to 0.155 p (1.25%) to close at 12.270, and Linde AG (DE: LING). Decreased in price by 1,750 p (1.11%) and completed trades. at around 156.100.

The leaders of growth among the MDAX index of components at the end of today's trading were the shares of NORMA Group AG (DE: NOEJ), which rose 1.90% to reach 40,550, TAG Immobilien AG (DE: TEGG), which gained 1.49% to close at the level of 12.560, as well as shares of Metro AG (DE: MEOG), which rose by 1.43%, ending the session at around 31.585.

Leaders of falling were shares of Hochtief AG (DE: HOTG), which fell in price by 0.78%, closing at 133.050. Shares of the company Lanxess (DE: LXSG) lost 0.75% and finished the session at 62.350. Quotes Krones (DE: KRNG) decreased in price by 0.49% to reach 86.900.

The leaders of growth among the TecDAX index of components at the end of today's trading were the shares of Pfeiffer Vacuum Technology AG (DE: PV), which rose 1.43% to reach 88,820, Nemetschek AG (DE: NEKG), which gained 1.17% to close at the level of 55.260, as well as shares of ST AG (F: SANT1), which rose by 1.12%, ending the session at around 8,600.

Leaders of falling were shares of Sartorius AG Vz (DE: SATG_p), which fell in price by 1.69%, closing at 70,500. Shares of the company Siltronic AG (DE: WAFGn) lost 1.44% and finished the session at 44.025. Quotes Draegerwerk AG Co (DE: DRWG_p) decreased in price by 1.41% to reach 79.490.

On the Frankfurt Stock Exchange the number of advancers securities (388) exceeded the number closed in the red (369), but rates of 25 shares remained virtually unchanged.

Stock Quotes Metro AG (DE: MEOG) rose to a 52-week high, up 1.43%, p 0.445, and finished trading at around 31.585..

volatility index DAX New Volatility, which is based on options trading indicators on the DAX 30 rose by 1.39% to reach 17.85.

Gold futures for delivery lost 0.19% in February, or 2.15, reaching $ 1.155,95 an ounce. As for other commodities, the price of oil WTI with delivery fell by 0.19% in February, or 0.10, to $ 53.67 a barrel. Brent crude oil futures for March delivery fell 0.26%, or 0.15, to $ 56.70 a barrel.

Meanwhile, in the Forex market EUR / USD pair rose by 0.60% to 1.0551, and the quotation EUR / GBP fell by 0.15%, reaching 0.8543.

USD index dropped by 0.48% to 102.17.

Related posts

US stock markets closed mixed

US stock markets closed mixed , Dow Jones added 0.40% The US stock market closed the trading session on Monday in different directions due to the...

Stock Asia traded mixed on Tuesd

Stock Asia traded mixed on Tuesday Today Asian stock indexes finished mixed. investors doubted the effectiveness of state intervention in the the Chinese...

Overview of Russian stock market

Overview of the Russian stock market and oil market Overview of the Russian stock market and the oil market. Russian stock market closed yesterday mixed....

Next posts

- Daily Economic Digest from Forex

- Markets in Europe Italian Government

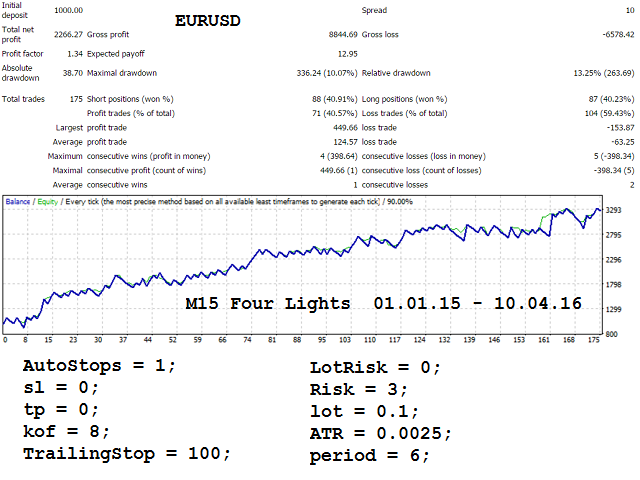

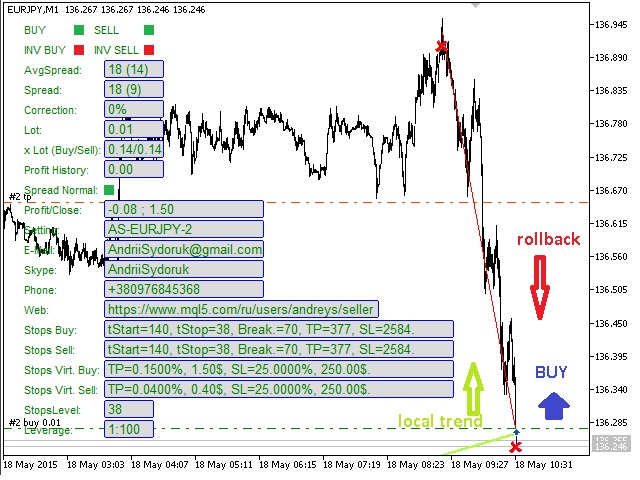

- MFC EA optimization set