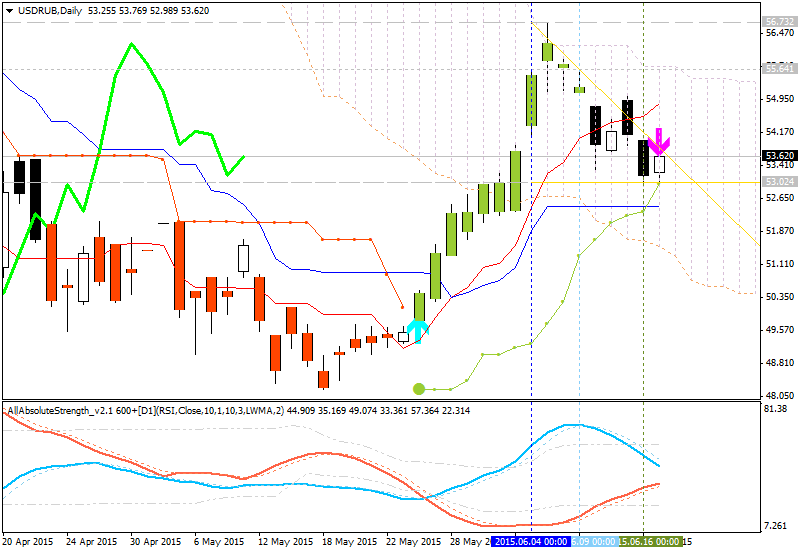

Dollar / Ruble (USDRUB) Technical Analysis - multidirectional correctional movement to the support level of 53.02

On day timeframe price is the primary upward trend of the secondary multidirectional corrective movement by testing the level of support and figure 53.02 motion 'triangle' to continue downward movement until the release of the cloud Ichimoku niskhodyaschenr trend in the primary zone.

D1 (price on the daily timeframe) - multidirectional movement correction in the primary upward trend:

- the price is within the cloud Ichimoku, that characterizes the channel multidirectional movement rates between the boundaries of clouds - line Senkou Span B and 'reversal' line Senkou Span A;

- 'Pivot' line

Senkou Span A, a virtual boundary between the primary downward and

primary uptrend is below the price and close enough to it for a possible reversal in the primary down trend in this and

the following week; - 'Probojnaja' Chinkou Span line is

too far away from the price, which makes it unlikely a sharp and rapid breakdown of cost

key support / resistance levels in the near future.

Trend:

- H4 - multidirectional downtrend

- D1 - correction inside the rising trend

- W1 - multidirectional trend

- MN1 - multidirectional uptrend

Related posts

Analysis of some currency pairs

Analysis of some currency pairs EUR using the Fibonacci instrument line 1993 Robert Fischer issued in "Wiley and Sons," a book tentatively titled...

Forex ee Economic Daily Digest

Forex.ee: Economic Daily Digest Daily Digest of economic Forex . ee Keep an eye on major economic news with us Monday, 8 August GBP / USD current price:...

BofA Merrill on AUD / USD, EUR / GBP and EUR / USD Contrary to expectations, AUD / USD has broken sharply below the 50d MA ... "The weakness should be...

No comments:

Post a Comment