USD / CAD: Bank of Canada's decision on interest rates

Current trend

The era of extreme

loose monetary policy of the American central bank comes to an

end. On Monday said Federal Reserve Chairman Janet Yellen,

He is stressing that "now the Fed gives the economy the possibility to move by inertia,

measured. "

published

Wednesday minutes of the March meeting of the Federal Reserve showed that the leaders of the Central Bank

USA inclined to to begin reducing the portfolio and treasury

mortgage bonds constituting 4.5 trillion dollars. many economists

equate reduction Fed's balance sheet to tighten monetary policy. This

the process usually leads to an increase in value of the dollar, because sale of government bonds

can pull in an increase in their yield and the dollar.

Janet

Yellen yesterday affirmed that interest rates in the US will reach approximately 3%

For two years (at the moment the current range of 0.75% -1.00%).

Janet Yellen

also he believes that in other developed countries, economic growth and inflation are restored

and, probably, the central bank will begin to curtail incentive programs.

In this regard,

it will be interesting to know tomorrow's decision by the Bank of Canada interest

rate, which is published at 14:00 (GMT).

Current

rate level of 0.5% in Canada. Canada is a net net exporter of oil, and

Oil is the main export commodity of the country. The Canadian dollar, while remaining

commodity currency, sensitive to oil quotations. The price of oil at the end of

last month, adjusted by 10% after a recent fall and continues

rise due to supply disruptions in Libya and Canada. In this case, Canadian

the dollar, which has a correlation with oil prices of 92% since the middle of last month, almost,

standing still.

If tomorrow

The Bank of Canada only hint at the possibility of an early increase in interest rates

Canada, the Canadian dollar strengthened sharply on the currency market, including in

pair USD / CAD.

And vice versa,

pronounced tendency of the Bank of Canada to continue the loose monetary

policy will contribute to weakening of the Canadian dollar.

In any

if during the period of publication of the decision of the Bank of Canada rate is expected to highest

volatility in the bidding for the Canadian dollar and the pair USD / CAD.

levels of support and

resistance

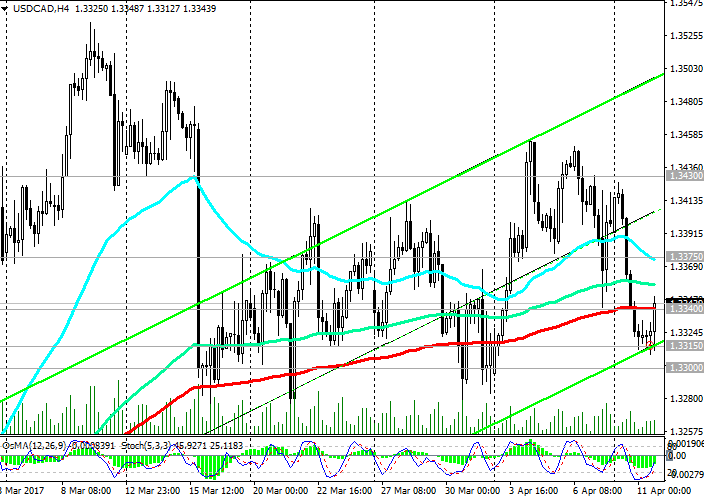

Since the middle of last month, the pair USD / CAD traded mostly in a range between the levels of support

1.3300 and resistance 1.3430. Currently the pair USD / CAD has found support near 1.3340 levels (EMA200 on 4-hour chart)

1.3315 (the lower line of the rising channel on 4-hour chart).

OsMA and Stochastic indicators do not give clear signals. Much of the dynamic pair USD / CAD will depend on tomorrow

Bank of Canada's decision on the interest rate and the accompanying comments.

In case of breaking the support level of 1.3300 USD / CAD pair will go to

the support level 1.3240 (EMA200 on the daily chart).

The reverse scenario is a short-term break

1.3375 resistance level (EMA200 1 hourly chart) and further growth in

the rising channel on the daily chart with the targets 1.3430, 1.3590.

levels

Support: 1.3315, 1.3300, 1.3240, 1.3200, 1.3155, 1.3100, 1.3010, 1.2840,

1.2760, 1.2635

Resistance levels: 1.3375, 1.3430, 1.3590, 1.3680

trade scenarios

Buy Stop 1.3360. Stop-Loss 1.3320.

Take-Profit 1.3375, 1.3430, 1.3590, 1.3680

Sell Stop 1.3320. Stop-Loss 1.3360. Take-Profit 1.3300, 1.3240, 1.3200,

1.3155, 1.3100, 1.3010, 1.2840, 1.2760, 1.2635

Related posts

DJIA Steven Mnuchin cheered inve

DJIA: Steven Mnuchin cheered investors US Treasury Secretary Steven Mnuchin during his yesterday speech said that the tax reform plan will be "very, very...

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) 13.07. fundamental analysis The focus today: The index of producer prices in the US Speech by US Federal...

Central Bank of Russia has reduced

Central Bank of Russia has reduced the value of the dollar and euro The Bank of Russia I set the official dollar exchange rate and euro on 1 November (on...

Next posts

- Analyst from company ForexMart

- Briton loses confidence against

- Ralph Lauren likely to bounce

No comments:

Post a Comment