Symbols Manager demo

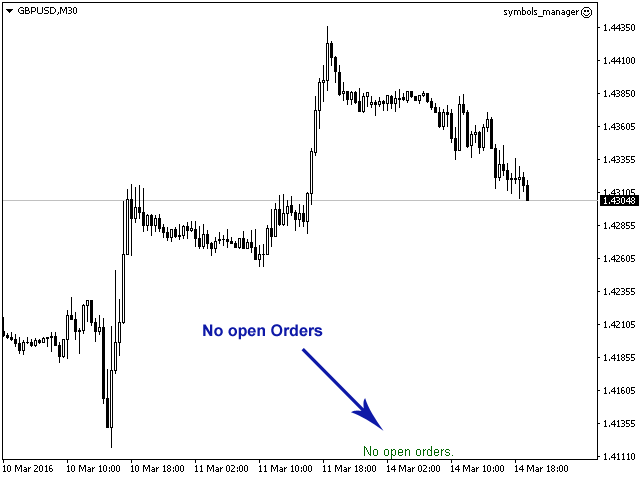

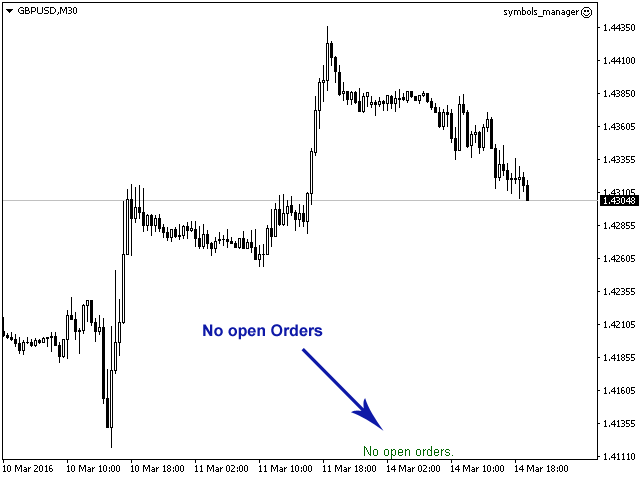

Free demo version. The grid manager symbols or manager is to manage a set of orders as a single transaction. Useful setochnikam and multicurrency, who may have a lot of orders for several instruments. You can close / turn / modify orders all at once for each character and direction. Install hidden stop loss and take profit.

Advisor can be run on any schedule and timeframe. Monitors the opening / closing of new orders, and adds them to the portfolio to which they belong. He believes margins and profits.

As the adviser works on a timer (times per second), it can be run and the banned trade will work as an indicator. Properly takes into account the four- and five-digit account, the minimum and maximum lots, different deposit currency. The comment line, and output the calculated takeprofit stop loss, depending on the amounts stated (in the input fields).

The graph shows the name of the instrument, the direction (buy / villages), the amount of lots, the amount of collateral, operating income (in the deposit means), the current TP (to deposit funds), the current SL (to deposit funds).

- in the green input field is established the amount of profit, above which the portfolio will be closed (can not be less than the current profit, if you put a zero - the closure will not);

- in a red box - the amount of loss, when the portfolio which will be closed (can not be more than the current profit, zero - the closure will not);

- Clicking on a line with a profit cause the closure of the portfolio;

- click on the description line (margin) will cause the issue of a coup portfolio, with a predetermined coefficient (if the coefficient = 0 is the closure).

commands

In the input box (except for the amounts of profit / loss) is possible to enter an adviser team, at the moment there are three: closeall, close and set.

- if you enter the command closeall or close all or all close or close___all will close all orders for all symbols (including deferred), but excluding orders with magico (if user specified with_magic_orders = no), Closure occurs starting from the first position;

- with the command close or _close_ or rvfdclose or closeal It happens the closure only of the portfolio, in whose field type the command, closing is sorted according to the settings;

- team set must be administered with the price Take Profit or Stop Loss (depending on the input field), or Stop Loss takeprofit be installed on all orders portfolio, for example: set1.25 or set 1,25 or 1,25set. If you need to remove the take profit or stop loss, enter the command set0.

The commands are executed immediately, without any warning. If you execute the command is not possible, an error message appears.

settings

- Stopping time From ... To - the length of time that the adviser stops any action other than checking is not performed (time is local).

- Multiplier for the coup - the coefficient to be multiplied by volume of the invert portfolio.

- Sound - beep when closing or overturning portfolio.

- With magic orders = no - indicates an adviser to ignore the order with magic numbers.

- Position on chart - sets the display position on the chart advisor - top or bottom.

- Sort orders = descend - in the preparation of the order portfolio is sorted by the last open to the first, that is, when you close the portfolio they will also be closed (from last to first).

- Sort symbol = ascend - Display of portfolios (characters) on the chart in alphabetical order.

Attention: This is a demo version which only works if the total volume of open orders is not more than one lot.

Related posts

Ultimate Panel Demo

Ultimate Panel Demo Control Panel "All in one on Ultimate Panel" helps to open and manage orders according to " trade in one click" system. This is the...

FC Money Manager

FC Money Manager This panel evaluates The volume of transactions and the ratio of risk reward ( Risk: Reward ) Based on said risk Interest ( Risk Percent...

Assistant Scalper Demo

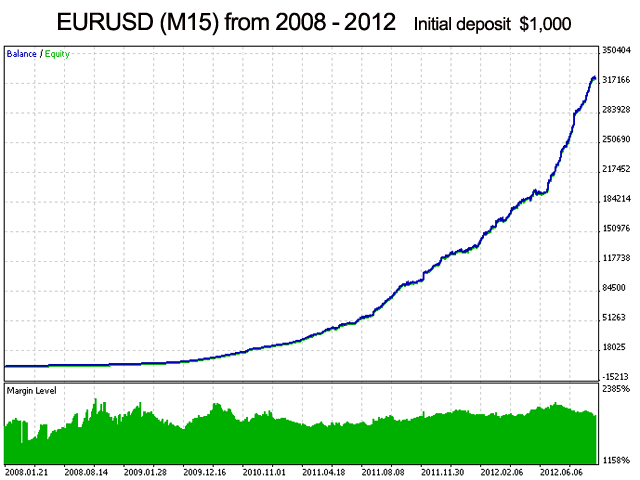

Assistant Scalper Demo This version of the advisor Assistant Scalper to verify the functionality of the pair EURUSD. Assistant Scalper - real helper in...

Next posts

- Trade Report Pro Demo

- FxConnect Basic Slave Free vers

- StartMainInfo