Analyst from the company ForexMart (ForeksMart)

Commodity prices forecast on February 10

Corrective growth of gold has been going on the eighth week in a row on the background of an unstable geopolitical situation in the world. Yesterday, traders recorded gains on the background of statements by Donald Trump that in the near future is possible exemptions in the regulation of the corporate sector and reducing taxes. Against this backdrop, gold rolled back to 1226.59 dollars per ounce. Today, the most likely pair will go to 1216-1211 and then unfold up to resistance levels 1227, 1232, 1238, 1241 and 1245.

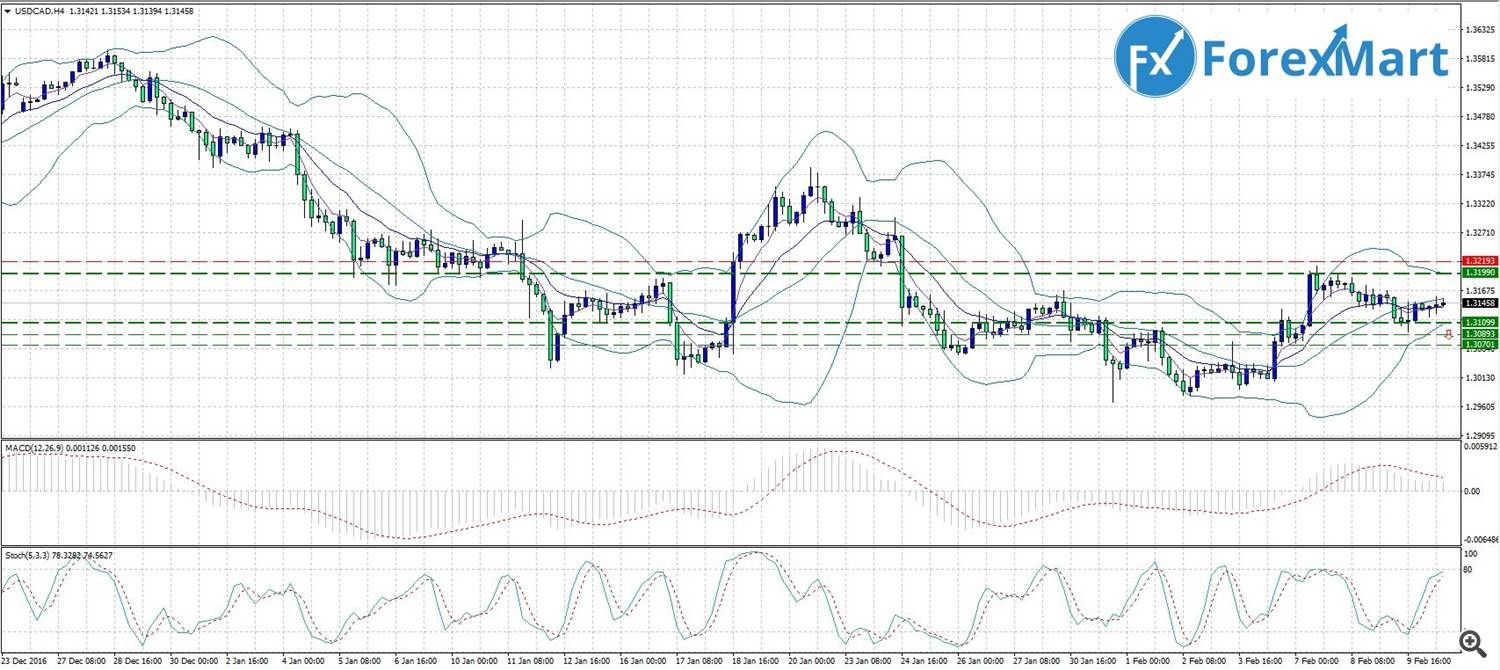

USD / CAD. 10.02.

Steam until the borders outset.

Today is expected to publish data on the labor market in Canada. A month earlier, the report showed an increase in the level of employment by 81.3 thousand. Experts suggest some pullback from this index, which is considered quite logical and do not regard it as bad news from the market. In general consideration, the state of the Canadian economy is regarded as a very stable and positive.

USD / CAD pair is moving within the outset with the boundaries of 1,3110-1,3197, formed on 7 February. MACD indicator is close to zero. Stochastic is in the oversold zone. It is assumed the price movement down.

Estimated levels of support can be located at around 1.3110, 1.3090 and 1.3070. Levels of resistance - 1.3190 and 1.3210.

GBP / USD. 10.02.

It is still unclear what will happen to the pound

Yesterday the pair tried to develop an upward movement, but the attempts were not successful - after reached a session high near the 1.2581 level, the pair started to decline and eventually closed the day near the 1.2495 level. Indicators do not give a clear signal that there will be the currency in the medium term is not clear. Candles are located above the MA 200, but below the MA 20,50 and 100. MACD is barely above zero and slightly rising, shaping a buy signal. RSI gives no clear signals and stored in the neutral zone.

Related posts

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) 13.07. fundamental analysis The focus today: The index of producer prices in the US Speech by US Federal...

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) USD / JPY. 30.05. "Doji" on 50.0 Fibo A currency pair USD / JPY week beginning with "Dodge," at simple MA...

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) EUR / USD. 11.04. The pair will continue to trade sideways Yesterday, the euro / US dollar resulted in...

Next posts

- Gasoline prices in Russia for

- S P expects that credit rating

- Influence of Ministry of Finance