FNA MT4

Two strategies in one EA!

Simple classic strategy of "breakdown at the level of fractals":

This strategy may be used on the timeframes M15 and above.

Input parameters

- _point - Away from the level of a fractal in points for placing a pending order;

- _stopLoss - Stop Loss value in points;

- _takeProfit - Take Profit value in points;

- MAGICMA - Magical expert number (Applies to both strategies!);

- TStop - Meaning trailing stop;

- TrailingStep - Step trailing stop;

- DecreaseFactor - Reducing the load on the deposit after losing trades;

- MaxRisk_perc - The percentage of available funds for the placement of new orders;

- fixedLots - volume mode selector lots of pending orders (false - sell a percentage of the deposit, true - minimum lot trade);

- Lot - The minimum lot for trading on a fixed volume of orders;

- TimeM - time for the start of trading advisor;

- TimeE - auction end time for the advisor.

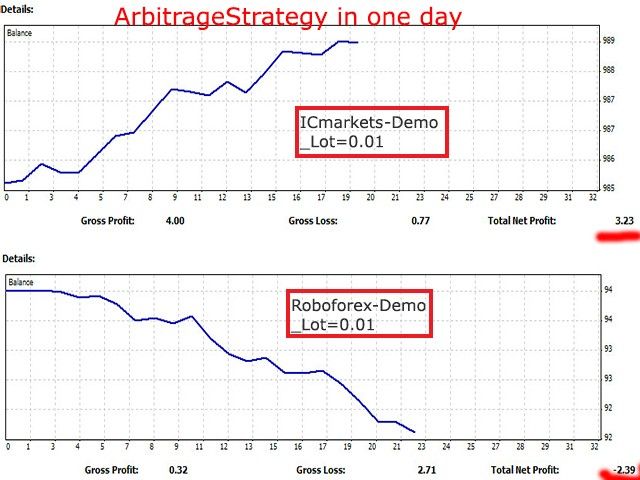

Strategy of "Arbitration" with the ability to conduct operations between two terminals of two different brokers.

Attention! Using the strategy of "Arbitrage" FNA adviser subject to the following conditions:

- The broker with whom you work, allows the use of such strategies in its terminal at Demo, and / or on a real account.

- two different broker and two MT4 terminal with access to the servers of these brokers need to work counselor in the "Arbitration".

- To work correctly, should bear in mind that instances of FNA advisor MT4 two terminals operate in a bundle via a shared folder all MetaQuotes terminals of your computer.

The path to the shared folder in Windows Terminal 7: C: \ Users \% UserName% \ AppData \ Roaming \ MetaQuotes \ Terminal \ Common \ Files \ - During operation, the adviser in the "Arbitration" is unacceptable to change the input parameters of one of the copies of the adviser, installed on schedule. If desired to change the input parameters to unload both copies of the adviser working terminals, and on the next boot set the desired input-parameters.

- FNA MT4 advisor author does not guarantee the profitability of the adviser of either of the two strategies you selected, and specifically disclaims any responsibility for the consequences of using FNA MT4 advisor in real trading.

Input parameters:

- ArbitrageCheck - switch strategies (false-strategy "fractals Levels" true-"Arbitrage" strategy);

- _symbolFolder - The main character folder for two copies of the Adviser to two different terminals (When installed on the graphics copies advisor, this folder must be empty or absent);

- folderMain - Folder for the current instance of operations with the current terminal advisor data (must coincide with the folder name "folderAlter" advisor second copy in another terminal);

- folderAlter - Folder data operations for the second instance of the second terminal advisor (must coincide with the folder name "folderMain" advisor second copy in another terminal);

- _millisec - integer parameter for the advisor timer;

- _points - integer parameter profit in points (exposing this option should be considered by the spread symbol kommisiya broker for the transaction and the possible slippage in the open position);

- MaxSpread - Maximum allowable spread for trading;

- _Lot - Offer to trade on "Arbitrage" strategy;

- Limit - switch type place orders (false-market orders, true-limit orders);

- turnover - Switch-type closing (false-close the transaction on earnings, true-close the deal by the appearance of a return signal to the opening position).

Input parameters of the two copies of the advisor in two different terminals operating in the "Arbitration" (except for the parameters "folderMain" and "folderAlter") must be the same!

Example setup and operation adviser in "Arbitrage," a look at the video.

Video

Related posts

Zone pips Zone pips - fully automated Forex- Advisor , which uses two types of orders : Buy Stop and Sell Stop. Advisor also uses the system recovery...

Robust Trader 20 EAs 9 most terrible secrets of scalpers who make you lose money Scalper tested under ideal spreads, i.e. 0.5 or 1.0 pips? Your broker...

Phantom Fully automated multi-adviser. Do not apply the martingale, grid trading . For protection use a stop loss. Powered pending orders permitted to...