USD / CHF: Dollar resumed growth

Current trend

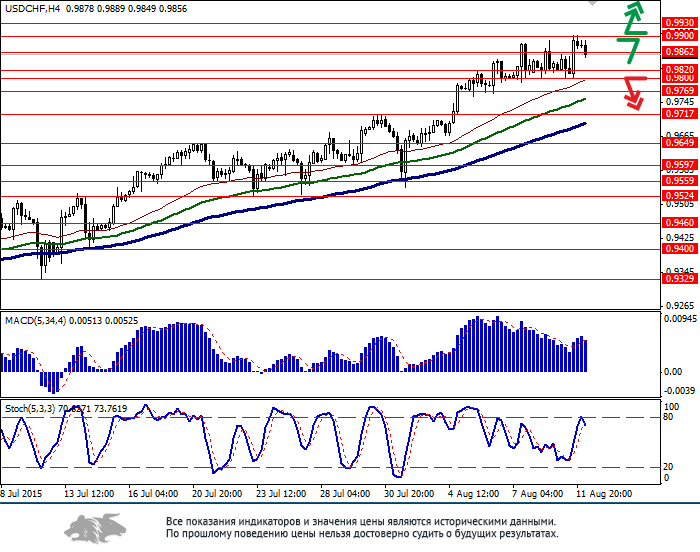

On Tuesday, the pair USD / CHF has resumed its growth after a small

correction of the US currency against major rivals. As a result, the pair

reached new highs since the end of March this year.

One of the reasons for such growth, in addition to a number of positive

macroeconomic publications in the US, we can distinguish a very sudden decision

Bank of China on the yuan devaluation. As a result of these actions the national currency

China fell to three-year lows.

Support and resistance levels

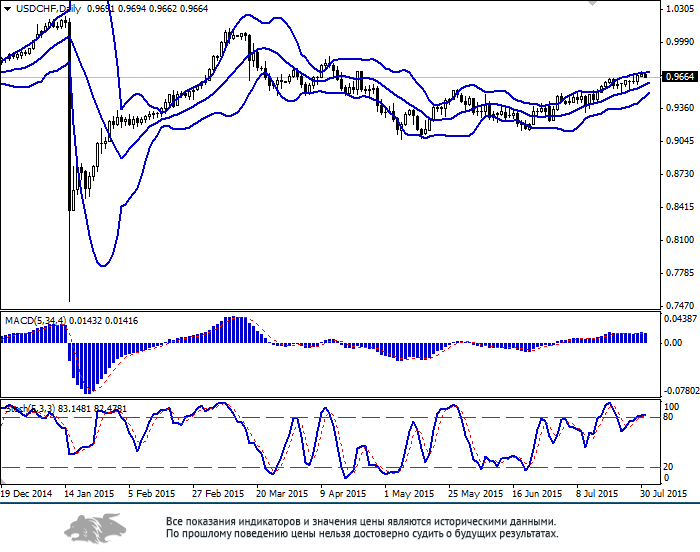

The indicator "Bollinger Bands" on the daily chart

It continues to grow, and the price range is expanding. Indicator signal formed

for sale due to the price breaks the upper range limit. MACD

turns down, forming a sell signal. Stochastic leaves the area

overbought, also signaling the sale.

Support levels: 0.9820, 0.9800 (at least 11 of August),

0.9769, 0.97717, 0.9649, 0.9597, 0.9559, 0.9524 (July 23 low), 0.9460,

0.9400, 0.9329 (July 10 low).

Resistance levels: 0.9862 (local maximum), 0.9900

(Psychologically important level, the high of August 11), 0.9930, 1.0000 (psychological

important level).

Short positions can be opened in case of breakdown to 0.9800 level

targets 0.9717, 0.9700 and stop-loss at the level of 0.9862.

You can open long position in the breakdown level of 0.9900 (at

support for the Indicators) to 1.0000 and stop loss at around

0.9820.

Related posts

Forex ee Economic Daily Digest

Forex.ee: Economic Daily Digest Daily Digest of economic Forex . ee Keep an eye on major economic news with us Friday, July 29 USD / JPY current price:...

Forex ee Economic Daily Digest

Forex.ee: Economic Daily Digest Daily Digest of economic Forex . ee Keep an eye on major economic news with us Monday, 8 August GBP / USD current price:...

RUBLE there are chances of growth

RUBLE: there are chances of growth fundamental base Russian currency still remains under the influence of oil prices. Today, after how the trading...

No comments:

Post a Comment