The forecast for the coming week on the DAX!

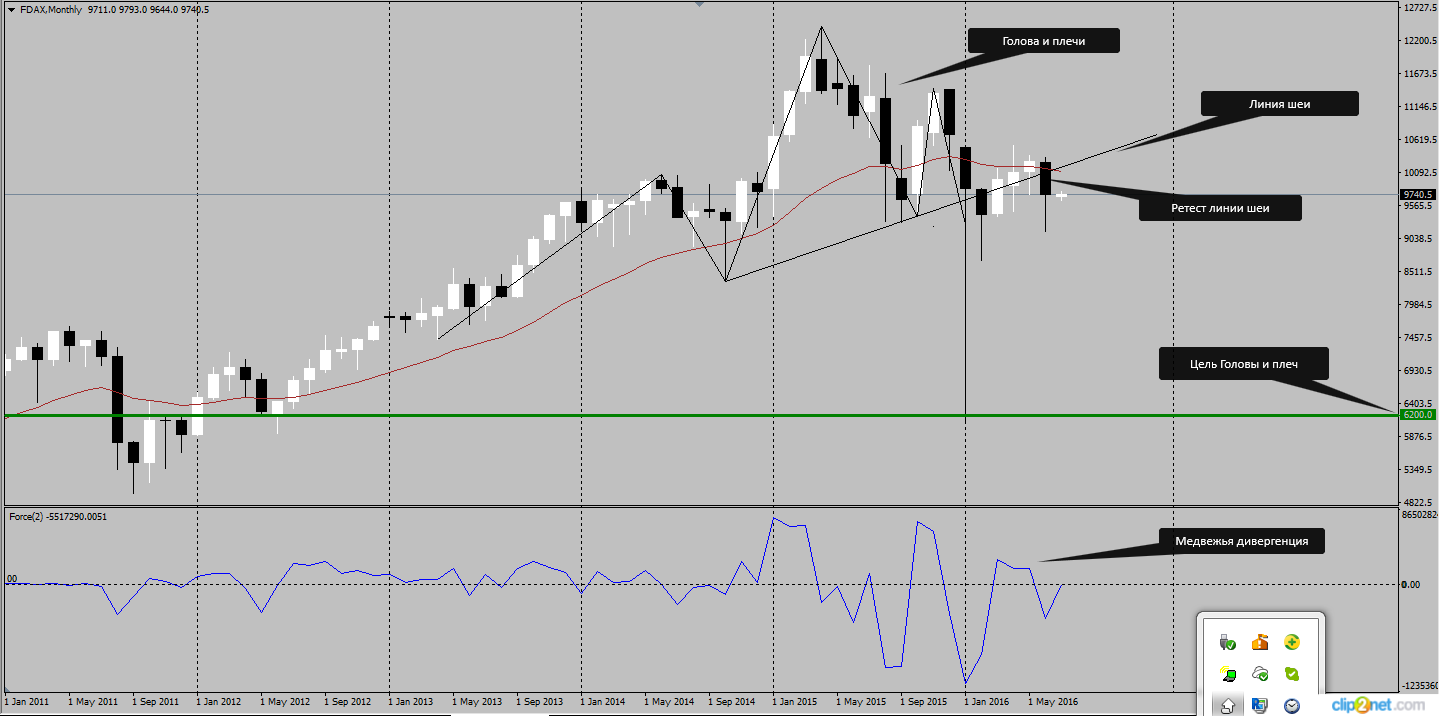

In the long term DAX expects the decline up to 6200. In this chart pattern shows us head and shoulders month trend. To date, the monthly trend downward against the backdrop of bearish divergence formed on the decline in trading volume at the EMA 21, the price is below the EMA 21, this development is graphically retest the neckline. Prospects for reducing the instrument in question is fundamentally justified by the further collapse of the EU, an increase in EU proposals on holding a referendum on withdrawal from the EU, for example, Hungary has already stated this, the situation will be shaken! Expect an increase in QE is not necessary, if the ECB wanted - it would have long ago realized. Problems at Deutsche Bank, Soros began to sell its shares. The lack of security in Europe, the possibility of terrorist attacks, the migration crisis. But all this is a long-term perspective.

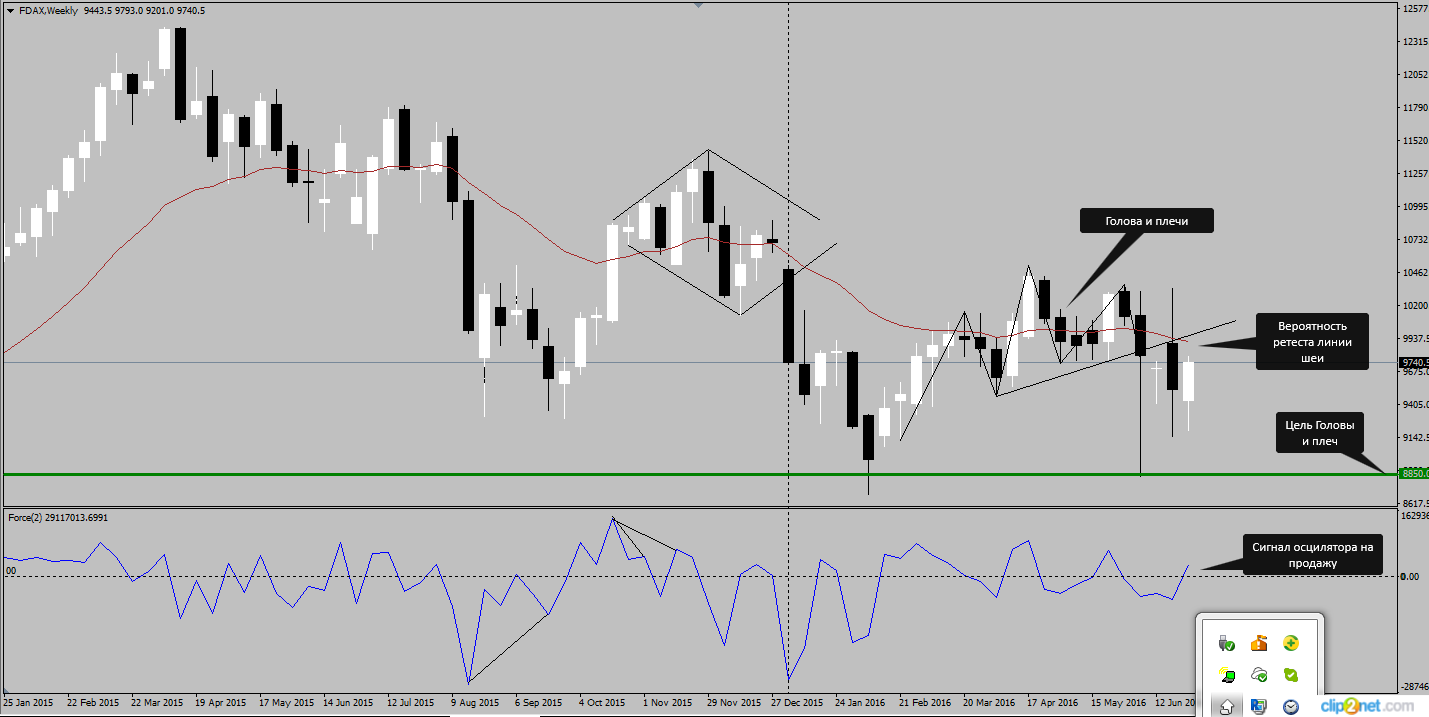

We turn to the weekly trend is that we are told to reduce in the medium term to the level of 8850! This indicates to us graphic pattern head and shoulders weekly trend. To date, the weekly trend downward since the price is below the EMA 21. It can be seen that the price strive to retest the neckline. Upon reaching the value of area rates (EMA 21) it is necessary to look for an entry point to sell, it tells us a sell signal generated by the index of forces in a downtrend EMA positive splash oscillator generated a sell signal.

Striving price to retest the neckline on the weekly trend is justified by one of the signals of the oscillator on the daily trend, extreme negative splash! But now we are seeing the emergence of the oscillator signal to sell, a positive splash oscillator in a downtrend EMA 21. Candle configuration "Harami" from "high wave" prepare the market for a reversal. We must remember that a bear "Harami" candle is not a strong signal. I think that the appearance of bearish divergence reference oscillator formed on a daily trend finish shaping for sale signal.

This confirms the graphical target on the four-hour trend on the level of 9880, formed an inverted head and shoulders.

To summarize, the following week is expected to price movement to the level of 9880, where the four-zone depletion trend will be formed, in which we will look for an entry point for further downward movement! On the further development of events on Monday! And we start with a search entry point to buy up to the level of 9880!

Related posts

Forecast for coming week for DAX

The forecast for the coming week for DAX Greetings, Friends! Previous forecast is quite a justified https://www.mql5.com/ru/blogs/post/677859. Those. the...

Forecast for tomorrow levels for

Forecast for tomorrow - levels for the EUR / USD, GBP / USD, USD / JPY EUR / USD : Konsolidaniya the continuation of the downtrend . Currently, the...

GBPUSD review and forecast traf

GBP / USD: review and forecast traffic Current trend On the Pound last trading session slightly decreased against the US dollar. Against the background...

No comments:

Post a Comment