The formula that has changed the stock market

It's amazing how the existence of mankind depends on mathematics, if one simple little formula can produce the global financial crisis.

BBC published an article about the formula that has changed the stock market and the blame for the current financial crisis. We are talking about the Black-Scholes model, which is used to evaluate the derivatives and equity finance companies.

Mathematical model of the Black-Scholes model, introduced in the 70s, gave birth to the life of a new financial system based on options trading, futures and derivatives. In this new system, there was nothing from the old classic stock markets. The phenomenal success and widespread formula has meant that Mayron Shoulz received the Nobel Prize in Economics in 1997 "for a new method of determining the value of derivative securities."

Generally speaking, the first futures began to be used in trade in the 17th century, in the Japanese rice market. Traders then began to enter into futures transactions, that is to set the price of the goods, the delivery of which will take place in the future.

By the 20th century on the American commodity exchanges have been in vogue not only futures, but also options - such as an agreement on the price of the future, but without the obligation to carry out the purchase. Options to buy "insurance" by the sharp price increase. Over time, traders have a desire to resell these options, it was difficult, because no one could answer the question: how much are these papers?

For example, how much is the annual option to buy rice at $ 100 at the beginning of the year, when the price of rice is $ 90, or one month before the expiry of the option, when the rice price is the same $ 90? Unknown. Here was born the revolutionary Black-Scholes model, which takes into account market volatility.

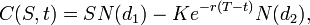

The price of the option call:

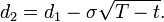

Where

Where

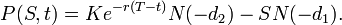

The price of the option put:

C (S, t) - the current value of call option at the time t until expiry;

S - the current price of the underlying share;

N (x) - the probability that the deviation will be smaller in terms of the standard normal distribution;

K - the exercise price of the option;

r - risk-free interest rate;

T-t - the time until expiration (the period of the option);

- volatility (the square root of the variance) of the basic stocks.

- volatility (the square root of the variance) of the basic stocks.

finance professor at Stanford University Mayron Shoulz was fascinated finances since childhood. More little he persuaded his mother to open an account, so that it can trade on the stock market. In 27 years, he was promoted at MIT and, together with his colleague Fischer Black (Fischer Black) seriously took up the definition of a puzzle for options pricing. As already mentioned, the key to unraveling began accounting directly in the formula limit market volatility.

Myron Shoulzm said that after a year and a half working on the formula they've seen elements of options in all objects of the surrounding world.

To the surprise of the authors, Black-Scholes model was used everywhere: in 2007 the volume of trade in derivatives in the world exceeded $ 1 kvardrillion that is ten times the value of goods produced in the history of human civilization. What was all over - it is well known.

Unforeseen changes volatelnosti markets led to unpleasant consequences for the financial markets. Now some experts call this a mathematical model of a "dangerous invention," which unduly simplify such a complex thing as the valuation of assets. The crisis of 1998 showed that a strong change in the volatility happens more often than expected, and therefore all of the assets will have to re-evaluate the new coefficients. Roughly speaking, swollen bubble of the global economy need to sozhit back, even though it means a prolonged recession in developed countries. And all because of the overly simplified mathematical model.

Incidentally, the hedge fund itself Knowles Long-Term Capital Management collapsed back in September 1998, less than a year after receiving the Nobel Prize.

PS Blog Comments there are also interesting.

Related posts

Stock Asia traded mixed on Tuesd

Stock Asia traded mixed on Tuesday Today Asian stock indexes finished mixed. investors doubted the effectiveness of state intervention in the the Chinese...

On Moscow stock exchange indexes

On the Moscow stock exchange indexes appear to help evaluate the effectiveness of state-owned companies According to the press service of the Ministry of...

US stock markets closed mixed

US stock markets closed mixed , Dow Jones added 0.40% The US stock market closed the trading session on Monday in different directions due to the...

Next posts

- Gloomy predictions of Bundesbank

- Oil futures stably reduced Monday

- Portugal not biggest problem in