8 main lessons for the 80-year history of the market

MarketWatch columnist

Paul Merriman in his article

It discusses what lessons need

drawn from the entire history of the market. offer

join his reasoning and

I represent an adapted translation

material.

What do you think, what

the most important knowledge should be at

investor?

Keep your expenses

at a low level? Supermenedzher hire?

To avoid paying taxes? catch the perfect

moment? These are all significant, but perhaps

the most important decision - is the choice of assets,

in which you invest. selection

asset class - a fancy name

for advice, of course.

In fact, to postpone

some money to invest then

these funds in the first place - is,

perhaps the most important step. And if you

do not do this, then you are not even an investor.

In the stock market you

You can invest in popular

growth stocks or shares at a low

value. You can invest in large

companies (large-cap) or

smaller companies (small caps).

You can invest in the US

stocks or international. Possible and

themselves developing equity markets to invest

funds and even funds

property.

According to experts,

more than 90% of your final yield from

investment depends on the choice of the class

assets. (This assumes that you have invested

money and leave them there. when you move

them from one of your other assets

the results are completely unpredictable).

There are some

the study of how the most popular

four American asset class

equity behaved for

recent decades. Many people

think, S P 500 index represents

"market"But it is not. In fact,

actually, for a long time

each of the other of his "colleagues" Indices

surpassed this figure is much,

and more than once. The author assures us,

that he might make a table with

an interval of one year, but for us also,

readers prefer more informative.

One of the reasons why he chose the period

10 years old, is an aphorism of Warren Buffett: Do not

something must buy if you are not sure,

that within ten years, this

asset does not leave the market.

Here are some of the findings,

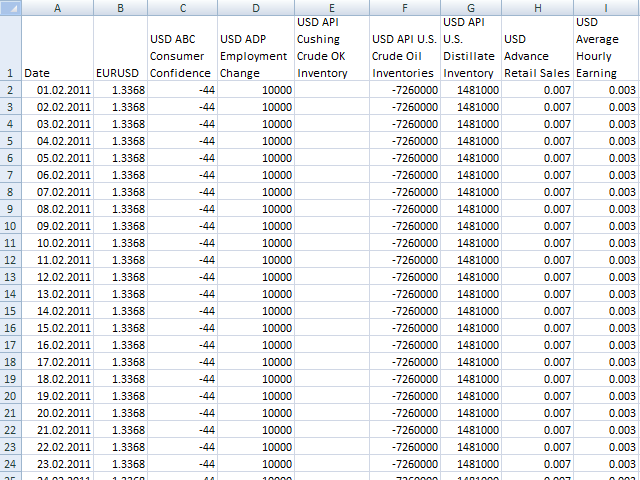

that the author did after comparing

assets - the index S P 500, U.S. Large Cap Value,

U.S. Small Cap and U.S. Small Cap Value. "Whenever

study table of investment returns,

I draw important lessons that help

understand the market and it does not surprise me their

behavior ", - says the author.

asset class

30-39 40-4950-59

60-69

70-79

80-89

90-9900-09

1930-2013

| S P 500 index | -0.1

| 9.2

| 19.4

| 7.8

| 5.9

| 17.5

| 18.2

| -0.9

| 9.7

|

| Large-Cap Value | -5.7

| 12.7

| 18.4

| 9.4

| 12.9

| 20.6

| 16.8

| 4.1

| 11.2

|

| Small-Cap | 2.3

| 14.9

| 19.2

| 13.0

| 9.2

| 16.8

| 15.5

| 9.0

| 12.7

|

| Small-Cap Value | -2.6

| 19.8

| 19.6

| 14.4

| 14.4

| 20.1

| 16.2

| 12.8

| 14.4

|

Here are eight things that

It can be understood from this table:

1. It is obvious that, when

compare indicators in increments of 10 years,

the market has grown most of the time. Of

The table shows that 28 of the 32 indicators

positive, and only four -

negative. By the way, three of them

occurred back in the 1930s.

2. The market can be very

successful consecutive decades. Most

investors recall that in the 1990s were

very high returns for stocks, but this

table shows an even higher

profit in 1980.

3. Leading and lagging

asset class is sometimes reversed.

This makes it difficult to select just one,

with whom you can be sure that he

It will always be on top. In the 1960s,

companies with small capitalization and

cheap stocks behave better. They

We did the same from 2000 to 2009. But,

in 1970 were ahead of all assets

large-cap and penny stocks.

In the 1950s, 1980s and 1990s, each class

assets in this table received double-digit

revenues, and 1940 have been extremely close.

4. The most consistent

The winners were stocks with low

capitalization and value. For 1930

s still got this asset class

Ten years ago the profit, which is always

It was more than 12.5%.

5. Only one

decade - 30 years - almost all

Group received profit. And if you

the math indicator for inflation,

it turns out that the return of this group

I was actually positive: up

1.4%.

6. The first 10 years of this

century was viewed as "lost"

decade for stock investors,

mainly due to the growth of expensive stocks and

pair serious bear markets. In that

decade of the portfolio, which was

is divided equally among the four

asset classes, earned a profit

about 6.7%.

7. Over the past 80 years

"market beating" It was very easy,

if you think S P 500 index.

8. Saying that investors

get paid to take risks seems to be working

very good. Stocks of expensive assets

They are riskier than S P

500, and they are paid more. Growth shares

small caps are more

risky than stocks with high

capitalization, and they will also receive

more. Shares of small-cap -

the riskiest among these classes

assets, and investors have received the most

higher yield.

thanks to the third

lesson, it is impossible to understand what classes

assets will work best for

next week, next month,

in the next year or even next

decade. But there is a magic that

You can combine all four of them

in one portfolio. In 84 years - from 1930 to 2013

year - this group of four assets

increase the annual income from 9.7% to 12%.

If you think

it's a bit, here's a math: $ 1,000

Investments in 1930 (equivalent to

$ 14,084 in today's dollars) would have increased

to $ 2.4 million (unless assume 9.7%) or $ 13.6 million

(At 12%).

Related posts

Bloomberg five main themes of

Bloomberg: the five main themes of this Friday , from Yanis Varoufakis to Nasdaq Bloomberg It lists the main events, which will be remembered for today's...

GBPUSD at end of year is expected

GBP / USD: at the end of the year is expected to increase demand for the dollar current dynamics at the last week British currency significantly...

Again about investments What is

Again about investments. What is dangerous about art investment? Even 20-30 years ago, hedge funds or private equity funds were some exotic for...

Next posts

- Currency market And now sell r

- No need to put up with cheap oil

- Ruble on Tuesday strongly weakens