Opinion: Bear stock market has already begun?

What to do,

if the bull market in stocks has ended,

just no one noticed? Such

question asks Andrew Laptorn chapter

department of Equity Research at Societe

Generale. And he has a few things,

who is on his side.

he also

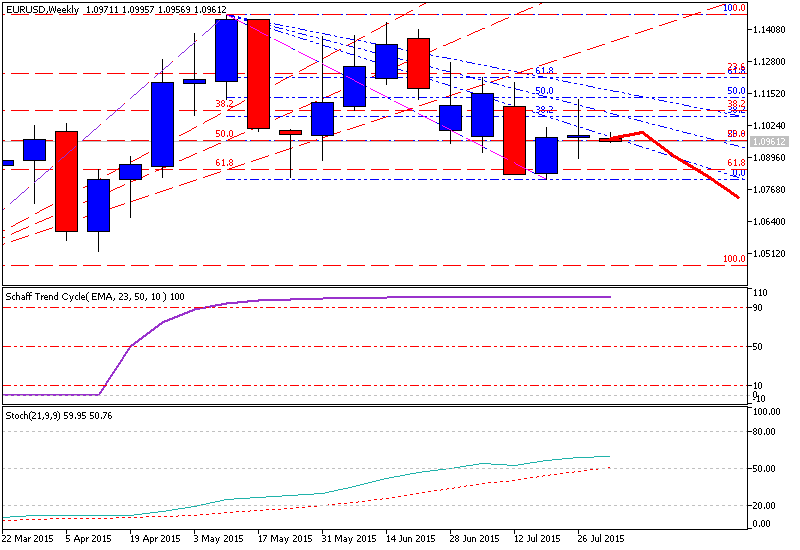

He says it's not just the recent

terrible fall in commodity prices,

but a real harbinger of slowdown

economic growth. And last

a collapse in emerging markets or

the recent collapse of the long-term interest

Rates confirm this.

And it was

not that the bull market, which

really it began in March 2009,

already incredibly old. So called

"Low quality" stocks that

more sensitive to the recession, suddenly

We started performing something bad, something good. FROM

the beginning of July as Laptorn notes, shares

"High Quality" They were crushed

stock "Low quality" in all

stock markets, including the United States.

Societe Generale sees

This is also a sign

that the bear market begins.

"When

look at the US stock market

through the prism of performance

investment can

to see that investors are positioning

themselves in this way, as it were

himself in a collision with a slowdown

economy"- says Laptorn. Him

warning may be timely:

Dow Jones Industrial Average fell again on Friday

more than 1,000 points from its

spring peak.

scary and

surprisingly, it's like the old

proverb "Sell in May and go away" -

this advice may come in handy now!

just what we needed.

Oil falls,

raw metals also not very

attractive lately. A

yield of 30-year Treasury

US bonds, for example, also fell to the

40 basis points - from 3.25% to 2.83%.

Long-term interest rates are

tend to be a strong barometer

economy. This sharp downward movement

- of course, negative.

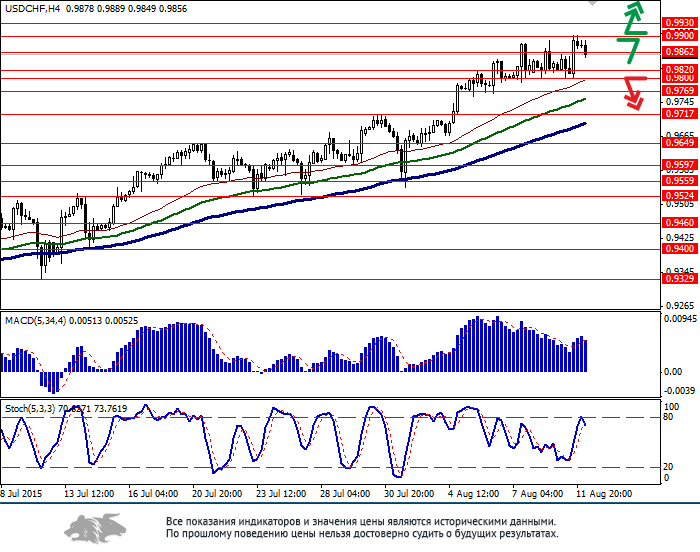

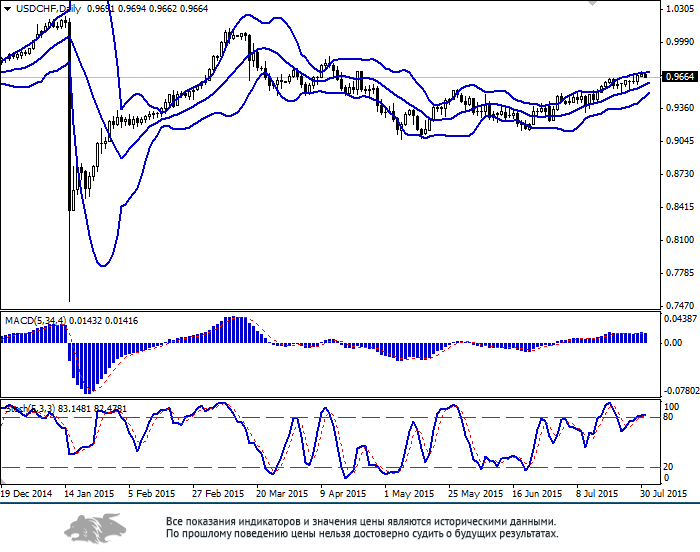

investors

already worried about the slowing

Economic growth in China, whose growth

was the engine of the world economy

For more than ten years. American

market participants even after strong

Friday's data on all jobs

More and more are waiting for the day when free

money will not. many economists

believe that the Federal Reserve

the system is likely to start raising

short-term interest rates

next month. But, as I suggested

Stenli Fisher, vice chairman of the Fed,

the central bank may still have to wait,

before raising rates.

Meanwhile,

Societe Generale also indicates that the boom

US stock market, which began in March,

2009 was the third in power since 1900.

As pointed out by the Bank's strategy, there are two more such

markets that were stronger and that

ended in 1929 and 1999, but in

fact, they did not end very well. And the truth, panic

or very experience has never been a good idea. According to

the late Dan Bunting, UK

investmenedzhera, "the fundamental

Economics always looks awful".

real

Now the danger is that US stocks

It is somewhere between expensive and very

expensive, based on various

historical estimates. costly

stock markets tend to provide income

below the average for a long

time virtually independent of

what is happening in the economy. cheap

markets, by contrast, are usually given high

profitability.

Of course,

nobody wants to be expensive shares

weak market. Usually, those who own

high-quality stocks or have

Good global investment portfolio,

They will worry about them much

stronger.

Related posts

Overview of Russian stock market

Overview of the Russian stock market and oil market Overview of the Russian stock market and the oil market. Russian stock market closed yesterday mixed....

Opinion crisis in emerging markets

Opinion: The crisis in emerging markets - the third wave of global financial crisis downturn in emerging markets - is not just a the result of the local...

Computing power of market structu

The computing power of the market structure Now we know that the market is an efficient machine for the distribution of funds between the parties. Now...

Next posts