Price Action from Nyala Fuller

How to create your own trading plan

I

found that most traders do not have a trading plan, they do not know how

him to do, or it is too difficult for them. Therefore, in today's lesson I

I want you to understand why we need a trading plan, and then give an example

trading plan that you understand how to create your own. Let's start…

What is the trading plan and why is it

need

At first,

trading plan should be seen as a pattern of trade in the market.

Perhaps the best way to describe the trading plan in the form of a checklist.

This checklist should comprise every aspect trade logical step

by-step sequence, and will act as a trade management

On the market. In fact, in the commercial terms will indicate your short- and long-term

trade objectives, and will give you a clear list of questions to test how their

to achieve.

Note: Do not think that your check

sheet / trading plan should be extremely long and detailed. After

you will learn an effective trading strategy, such as Price Action, you will be able to combine all aspects of

your trading method in short form. Having done it once, you will have a check

sheet / trading plan, which will open the leadership deal or not.

Checklist can contain text and pictures, I'll show you an example below.

Cause

which you need to have a trading plan it is that you have to be

sure that trade is not based on emotion. Trading can be highly

emotional exercise, and if you follow the objectively constructed

trading plan, which defines all your actions on the market, you will almost

certainly become emotional trader, also known as Trader

losing money.

Maybe,

the most beneficial thing that makes shopping a plan for you, is that it

It keeps you away from the uncertainty in the market. This naturally reduces the

the number of losing trades that will improve the overall percentage of winning

transactions. Many traders will eventually "run and shoot" in the markets in place

In order to learn to trade like a sniper, and the reason why they are doing it in

that can not set aside time to create your own effective trading

plan. I'm telling you right now, the quickest way to increase your profits,

is to trade less frequently and with great quality. trading plan

naturally help us in this endeavor, and now let's see

on the various components of an effective trading plan:

Components of a trading plan on market

it

the necessary components of a trading plan, you can add something if you want,

but do not get too carried away, so that your plan does not become too long and complicated.

·

Start

your trading plan with positive affirmations that will read aloud;

·

specify

your short- and long-term objectives in trade in the markets;

·

Determine

your trading strategy, all aspects of how you analyze and trade;

·

Determine

Your money management strategy which includes such things as the ratio

risk and return, a real profit margin in the current situation, how much

I can lose in a single trade, what is my strategy with respect to withdrawals,

merchant account, how much I'll shoot every month, after going to

trade profitably.

·

Various

commerce components that must be checked, such as the basic currency

pair, trading hours, news, etc .;

·

Twice

all check before opening the transaction, and ask yourself: "This transaction is open,

because I thought that if you do not fool

bargaining, or because I was considering a deal for an hour and found an excuse

transactions in 20 different sites on the Forex? ";

·

Complete

trading plan / checklist another positive statement.

An example of a trading plan

(Note: this is a hypothetical plan - drafted

arbitrary, but you can use it to create your own

plan. It's not part of my personal plan, but they represent my structure

trading plan. You may want to add other components

checklist, as it is only a general example might look like

trading plan.)

trading plan

--Installation trade:

"I never

I will not enter into a transaction without first checking with the trading plan, as

trading plan makes me objective and eliminates the emotion in trading, and this is

that makes me profitable

long term "; "After entering into a deal, I do not change, and do not touch

transaction excludes all emotions and remember their initial observations "; "I

I never traded above the risk threshold, adhering to set the amount of risk in

one transaction. "

--Business objectives:

short-term

objectives: to make constant profit every month, complemented by income from my

basic work to be patient and disciplined trader

which follows the plan.

long-term

goal: to bring your account up to the amount of $ 25,000 and above, through a thorough mastery

my trading strategy, patience, and discipline to follow my trading

I plan each time opening deal. To avoid peretorgovyvaniya be

patient, stay disciplined and always adhere to the trade

plan.

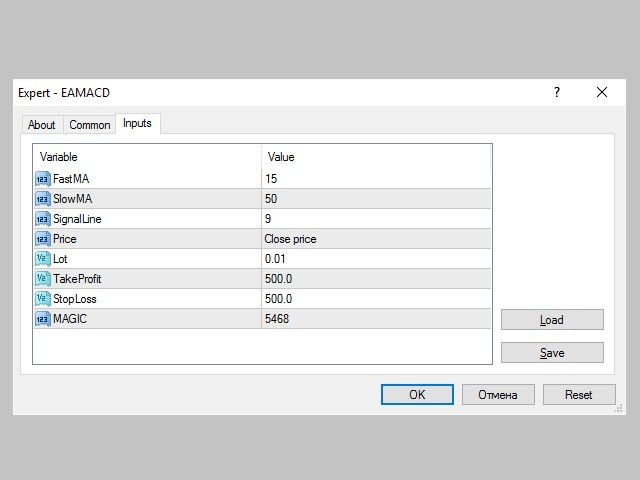

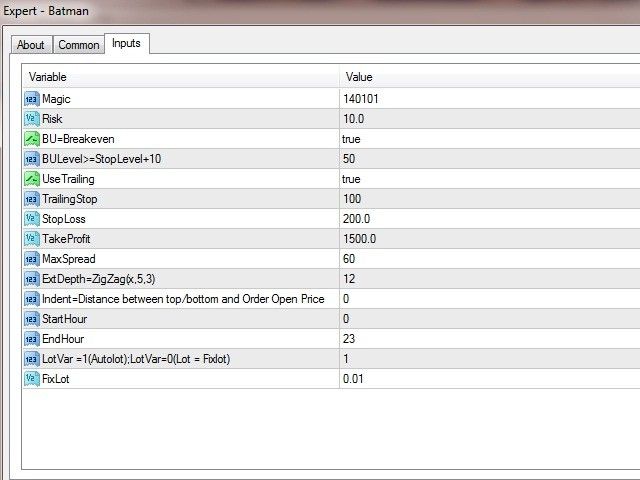

--Trading Strategy:

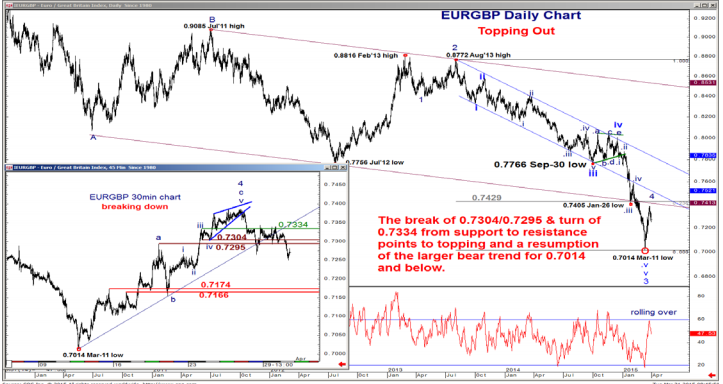

1) Market analysis - market trend or

consolidated? - This is the first thing that

to be determined. You need to determine the main direction of the market and

try to trade in that direction. We look for new highs and peaks

troughs in a growing trend, and new lows valleys and peaks to the downward

trend, as I learn how to use the 8 and 21 day EMA to determine the short-term

market pulse. For the market to consolidate, we look at obvious levels

support / resistance. Therefore, your trading plan, you must have

pictures, as in the example, or similar, in order to remind you that

you need to look for:

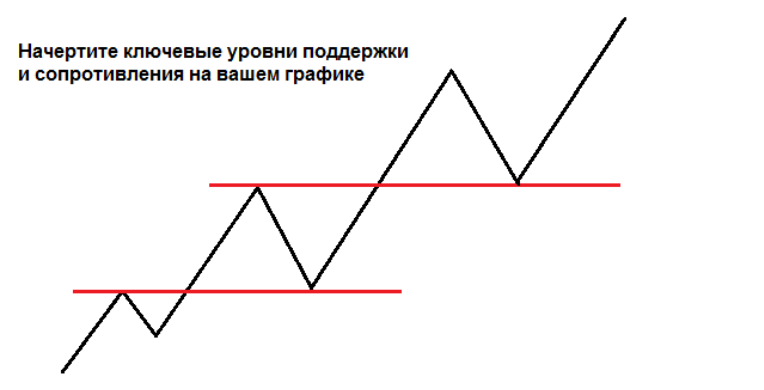

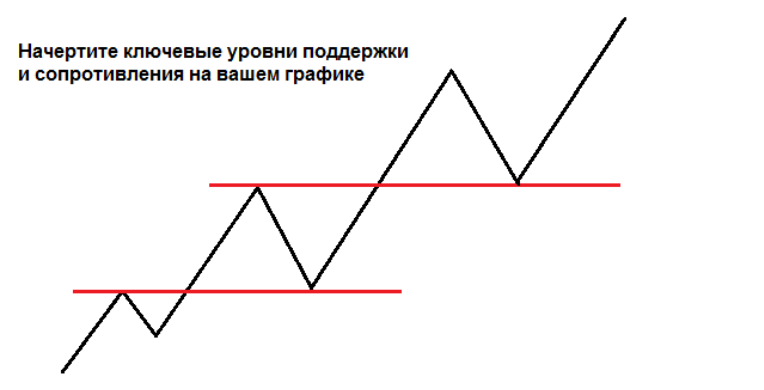

2) Identify the main resistance levels and

support and draw them on the chart. - Once you have identified

state of the market: the trend is up, down, consolidation, it is necessary to draw key

support / resistance levels on the chart. They will indicate the zone of interest

market participants, for which you will watch in anticipation setups Price Action in the direction of the main trend, or

in the case of consolidation in the direction of the opposite side of the range.

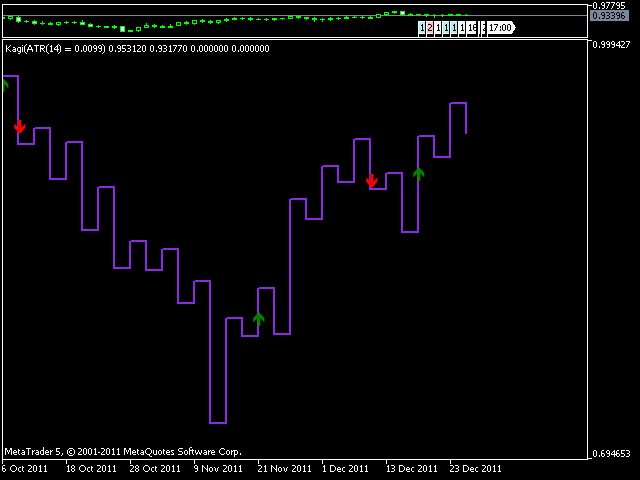

3) Search setups Price Action formed on

Key levels to make sure that only trade obvious signals. - You need to know exactly what setups Price Action are looking for on the chart before

build your trading plan. Below we can see an example of bearish Pin Bar in

downtrend. You have to be a perfect example of the drawings setups

that you will trade according to your trading plan. It will be you

a reminder of what setups with high probability you are looking for.

-- money management

1) What is the most logical place to

stop placement? What amount I can donate and still feel

quietly? - Remember

it is necessary to calculate the risk of the money, not points or percentage.

2) What is the most logical exit strategy

where to place closed orders? - The ratio of risk / reward 1 to 2

or more seems reasonable achievable in the transaction taking into account market conditions

and the next level?

-- other considerations

1) What currency pairs I consider to

trade? This is the major currency pairs: EURUSD, GBPUSD, AUDUSD, USDJPY, EURJPY, GBPJPY, USDCAD, NZDUSD?

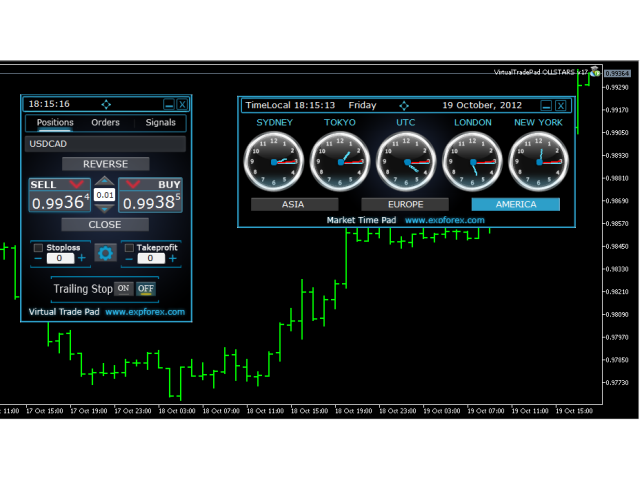

2) In a trading session formed

this setup? It is formed during the London or New -Yorskoy session

which are the most important, or during a quiet Asian session

-- Double check your transaction

Make sure that you trade only

the obvious setups.

Conclusion

I hope,

that you have a better idea how to build your own trading plan as

its structure and what ingredients it should contain. there really is

there is nothing more to tell, but added that the creation and use

your trading plan will allow you to achieve your goals at a much market

faster than without him. You have to believe me and stop trading without

plan. You do not start a business without a business plan is developed on paper

why do you think that you can successfully trade without proper trade business plan.

creating

Once your trading plan, you need to make sure that will really

use and follow it each time interacting with the market. This will

to produce you right shopping habits, such as patience and

discipline, and these are the habits that help you make money in the long

term.

Author

Article: Nial Fuller.

Related posts

Trading Psychology first 3 points

Trading Psychology. The first 3 points of immortality. Today is not an ordinary article, which says that everyone knows, but can not win everything....

Price of Brent crude oil fell

The price of Brent crude oil fell below $ 40 The price of Brent crude oil for the first time since mid-March has gone below the important psychological...

Path novice trader What is it

Path novice trader. What is it? Path novice trader. What a novice trader faces, and what steps it needs to go. Almost every person who trades the forex...

Next posts