Daily Economic Digest from Forex.ee

Daily Digest of economic Forex.ee

Keep an eye on major economic news with us

Thursday, April 6

Couple EUR / USD has come under pressure from the

bears in early European trade as the market reacted aggressively to "pigeon"

statement by the President of the ECB M.Dragi that caused the euro to lose all their positions,

earned yesterday. In his speech M.Dragi noted that the growth rate

Inflation remains still low and therefore the revaluation of the current state of monetary

the policy would not be viable, thereby forcing a couple again to update it

3-week lows at around 1.0629. At the moment, all the attention of the market

It switched to another important event this Thursday - meeting of the President

China's Xi Jinping and US President Donald Trump, where we will discuss

the main issues related to further relations among the countries. Looking ahead,

later in the calendar of events will be presented only minor releases of

both economies, so market participants will continue to discuss the recent

address by the President of the ECB M.Dragi.

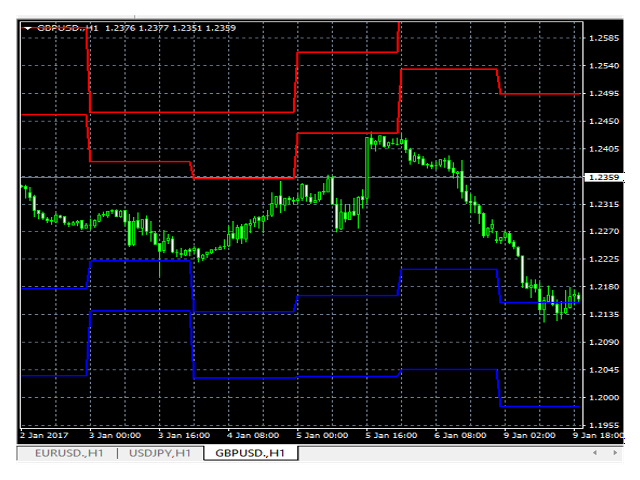

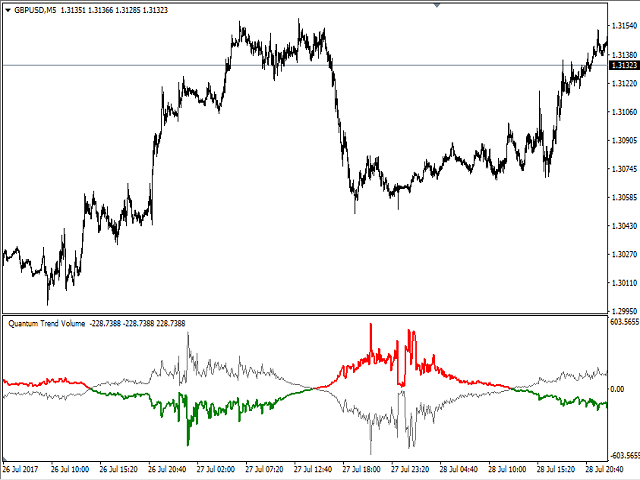

Couple GBP / USD consolidated its yesterday

rise, but after failing to hold above 1.2500. Yesterday the pair fell into

field of view of the buyer after the United Kingdom published

Positive data on the index of business activity in the services sector, allowing

pound to recover some of their positions lost after a series of weak macroeconomic

indicators. Moreover, the pair received further support amid

Publication FOMC meeting minutes, which showed that the majority of the committee members in favor of a reduction

the balance later in the year, however, without giving any details about the

how it will be done. On the other hand, the continued risk aversion on

background of the upcoming meeting between Chinese and US states that already starts

today, it limits the further rise of the pair. Meanwhile, both economic

calendar today will remain relatively quiet, so the general market sentiment

will remain the main driving factor in the course of the trading session.

Jena continues to remain upbeat in tandem with the US dollar, showing one of

the best results during the Asian session, amid the weakness of the dollar and

continued risk aversion. Yesterday the USD / JPY has come under strong

pressure from the bears, as the FOMC minutes of the meeting have not been able to bring clarity about

plans Fed representatives to reduce the size of the balance of this year. Such intentions have a negative impact on

expectations of investors about the aggressive monetary tightening

Fed policy, thereby forcing the dollar down across the board. Today

the pair will continue to remain under pressure as the continuing increase in interest

traders to less risky assets continues to be one of the main

drivers on the market, providing a beneficial effect on the yen. Today, against the background of relatively

quiet session meeting of the heads of states of China and the United States will remain at the center

attention, as will ask further development vector pair.

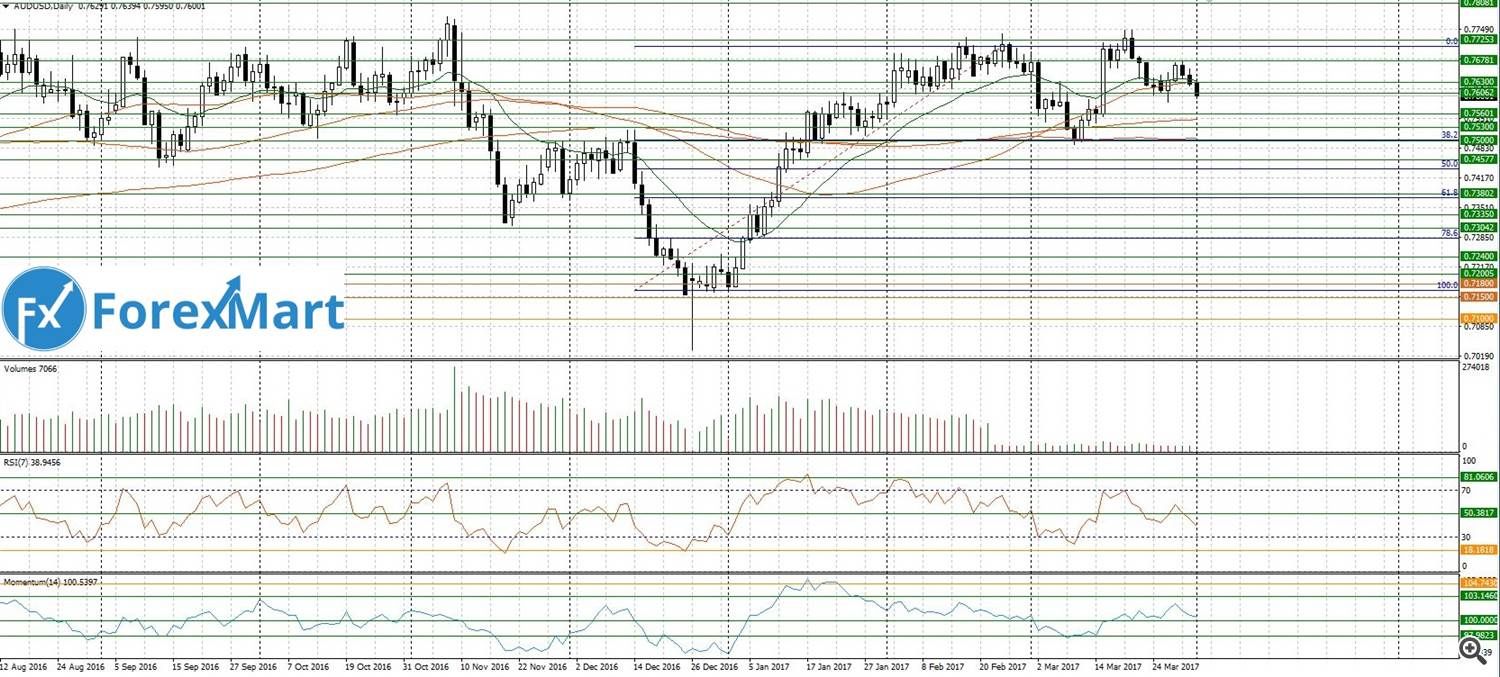

Couple AUD / USD plummeted to monthly

minimum located at the level of 0.7532, after China introduced

disappointing data this morning. Looks like,

that bears on the Aussie continues to ignore the widespread weakness

US dollar, formed on the background of the FOMC minutes yesterday, which

Committee members have shown intention to reduce the Fed's balance sheet at the end of this year.

Moreover, the pair continues to trade under pressure on Thursday, remaining

near its recent lows as well as the growing cautious ahead

meeting, China and the US presidents, as well as the ongoing weakness in the

Commodity markets limit the chances of the pair to recover. The list

Event planned for today only minor reports, so traders

will closely watch for any news about the meeting of two leaders

world's largest economies.

main

events of the day:

There are no

levels

Support and resistance for the major currency pairs:

EURUSD P.

1.0607 C 1.0717

P. S. USDJPY 109.97 111.81

GBPUSD P.

1.2392 C 1.2544

USDCHF P.

0.9974 C 1.0114

AUDUSD 0.7540 P.

S. 0.7600

NZDUSD P.

0.6912 C 0.7008

USDCAD P.

1.3356 C 1.3480

The best conditions for the start at the STP only Forex.ee! Sign up account is now

and feel the difference with the first deal!

your Europe ECN-broker,

Forex.ee

Related posts

Daily Economic Digest from Forex

Daily Economic Digest from Forex.ee Daily Digest of economic Forex . ee Keep an eye on major economic news with us Wednesday, May 3 Couple EUR / USD I...

Daily Economic Digest from Forex

Daily Economic Digest from Forex.ee Daily Digest of economic Forex . ee Keep an eye on major economic news with us Wednesday, August 30 Couple EUR / USD...

Daily Economic Digest from Forex

Daily Economic Digest from Forex.ee Daily Digest of economic Forex . ee Keep an eye on major economic news with us Thursday, July 20 Couple EUR / USD It...

Next posts

- Analyst from company ForexMart

- Macron wins Le Pen in second round

- Forecast from company ForexMart