Analyst from the company ForexMart (ForeksMart)

USD / JPY. 30.05. "Doji" on 50.0 Fibo

A currency pair USD / JPY week beginning with "Dodge," at simple MA (50) to D1. Today the pair dropped to the level of 110.80 and is moving toward the target at 110.20. Japan's Nikkei 225 fourth consecutive trading day to fall.

Bears found support at the round price level 111.00 on H4 and is likely to try to test the next Fibonacci level, located at 110.50.

GBP / USD. 30.05. The situation is ambiguous on the pound

Yesterday the pair closed the day with growth above the Pivot 1,28368 level. Today, the pound slightly adjusted down, and now is trying to foothold above the Pivot 1,28282. Indicators confirm the intention to grow a pair. One can try to buy, but still recommended to wait for the precise penetration resistance or support level to confirm the situation in the pair. Support level: 1.28071, 1.27789, 1.27578. resistance level: 1.28564, 1.28775, 1.29057

USD / RUB. 30.05. Couple quiet near 56.30

Yesterday's trading activity did not differ because of the weekend in the markets in China, the UK and the US. the dollar quietly moved around the level of 56.27 rubles. Support to the ruble has growing oil. Quotes Brent able to recover to the level of $ 52.30 a barrel after a drop caused by the outcome of the OPEC summit. However, the negative impact caused by the intention of the Group of Seven countries to toughen anti-Russian sanctions could negate all the positive role of oil in the ruble position.

Today, the couple will again stick to the side speakers on either side of 56.30. Stochastic indicator is a top-down shot oversold zone boundary that indicates the strength of the "bears" for the pair USD / RUB. MACD entered the negative zone.

EUR / USD. 30.05. The euro will continue to decline

According to the results of yesterday the pair went to the level of Pivot 1,11888 and S1. Now the euro is below all SMA, below the level of Pivot 1,11516. Indicators show the short-term restoration of growth. Today expected small correction up with consequent reduction in the level below S1. Support level: 1.11149, 1.10963, 1.10596. resistance level: 1.11702, 1.12069, 1.12255

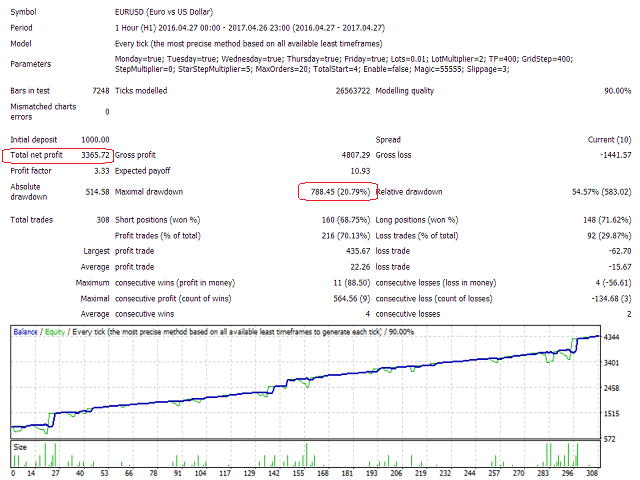

AUD / USD. 30.05. The trend down

The currency pair AUD / USD did not develop according to the movement pattern of "pin-bar" on the daily chart, but continued a downward trend. Ozzy yesterday's daily candle formed a "doji" below the level of 0.7450.

On the bears H4 simple test line MA (100) with the immediate goal on a round 0.7400 level. In the near future we can go back to 0.7450 but expect the development trend downwards.

NZD / USD. 30.05. New Zealand dollar moves to the upper boundary of the channel

The New Zealand dollar continues to trade in an uptrend, localized at its upper limit is already a long time. Rebounding from the support level 0.7033, quotes the New Zealand dollar moved up to 0.7075 resistance. Fastening quotations above psychological level of 0.7000 gives "bulls" on kiwifruit sufficient capacity for further growth. The loss of this level will allow the US dollar to bring the situation under control and ease the upward momentum.

Bollinger bands show a slight narrowing of the channel volatility. The RSI is moving largely in the neutral zone, MACD - in the positive area. During the day, we expect the NZD growth of quotations to the upper boundary of the current channel.

USD / CAD. 30.05. Couple in a narrow sideways in anticipation of additional drivers

Currency pair USD / CAD continues to adhere to the side speakers on either side of the 1.3460 level. Yesterday the US markets, the UK and China have been closed, so the actual position of the pair will only be clear today. The main trend still remains "bearish", while the dynamics of the oil is positive. Today at 17:00 will be published statistics from the US consumer confidence index. It is expected a decline. In addition, reports from the US Department of Energy and the API can also influence the further movement of the pair.

During the day the flat is expected within a narrow range. Resistance levels: 1.3495, 1.3520. Support levels: 1.3425, 1.3400. MACD indicator rises from the negative zone, Stochastic overbought. Bollinger Bands shows the restriction channel volatility.

EUR / GBP. 30.05. The downtrend in the pair

Yesterday the pair ended lower. Today's session, the euro / British pound opened under the level of Pivot 0,86946 and continued the downward trend, falling to the level of S1 0,86775. Indicators show a decrease in the pair. Forecast for today implies a decline in the area of 0.8670. Support levels: 0.86775, 0.86703, 0.86532. Resistance Levels: 0.87018, 0.87189, 0.87261.

USD / CHF. 30.05. Bulls test 0.9800

Currency pair USD / CHF has adjusted to the round price level 0.9800 and then continued trading on the slide. Swiss need deep correction after falling 4,000 points, the upper limit of which is located in the 38.2 Fibonacci retracement on the 0.9850 mark.

On H4 pair SMA fixed above the line (50), but met strong resistance at 0.9800. Possible retest of 0.9800, the actual support is located at 0.9750.

30.03. fundamental analysis

The US dollar strengthened against the major currencies as the British pound and the euro weakened due to the political uncertainty in the election background.

Around US President continues scandal because of the "ties with Moscow", which interfere with the program of fiscal stimulate the economy.

The vast majority of traders expect an increase in interest rates at the next Fed meeting in June, but did not believe in the continuation of "hawkish policy" regulator this year.

The Japanese yen strengthened against the British pound, the euro and the US dollar, which means a decrease in risk appetite in the global currency market.

Related posts

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) 13.07. fundamental analysis The focus today: The index of producer prices in the US Speech by US Federal...

Analyst from company ForexMart

Analyst from the company ForexMart (ForeksMart) Technical analysis of the levels of Pivot 22.06. EUR / USD By the end of yesterday, the pair could be...

Forecast from company ForexMart

The forecast from the company ForexMart (ForeksMart) Forecast NZD / USD Aug. 29 The currency pair New Zealand Dollar / US Dollar finished the last...

Next posts

- Wall Street banks were at impasse

- ECB President Mario Draghi confirmed

- Trump asked former head of FBI