statistic Trader

Expert statistic Trader - this

trading strategies, based on two ideas: the idea of probability

occurrence of an event and the idea of money management. The expert gives the trader a huge

opportunities in terms of settings and determine the level of risk.

The idea of probability:

maybe

I get an equal chance to make a profit or loss, if the Take Profit More Stop Loss? Maybe!

Expert

transmits the first N transactions (spends virtually the appearance of the signal), and only after receiving N consecutive losses

It reveals the real position. If N = 0, the first deal is real. If for example N = 2, the actual position will be opened

Only after two consecutive losses. If after the first virtual unprofitable

second transaction virtual transaction will be profitable, the expert will start the countdown

again. If the examiner will open the real deal, and it will be unprofitable, he (with

signal appears) open next. And so - 10 times before profit.

After making a profit (on any of the ten series of steps) to stop its expert

work.

I

I consider the price change of the asset as a random or not analyzable

process (because of the huge number of factors affecting it). For a trader to open a position, there are two

outcome - profit (Take Profit) or

of loss (Stop Loss).

Numerous tests on different currency pairs, different time periods,

different settings have shown that the results are subject to a certain scheme.

The main factors - the size of Take Profit and Stop Loss, and not at all the indicators and filters

etc. If Take Profit is Stop Loss, the probability of occurrence for them

is, if Take Profit Stop Loss longer, the probability of occurrence of Stop Loss is favorable, ie Stop Loss will occur more often and more often

precisely to the extent in which it is less than Take Profit. EXAMPLE: Take Profit = 100, Stop Loss = 50. When making absolutely 1000

random trades about 33% complete profit, about 67% - a loss. Moreover,

The more transactions, the more the proportion of distribution of profit and loss

transactions.

But

even after a long series of Stop Loss Take Profit should occur. In order to determine how much

transactions to be missed, it is necessary to conduct regular testing. Statistics

shows the average number of losing trades in a row happens. And correspondingly,

so many of them it is logical to miss. Of course, sometimes expert will

skip and a potentially lucrative deal, but for a long period of time

he will avoid many initially losing trades.

The idea of money management:

many

deter aggressive money management methods, such as doubling the position

after a loss, due to the fact that a series of losses can become so long that

a trader can not open another position and lose all or most of the

deposit. But definitely give up the opportunity in the next transaction

recover losses and make a profit is not worth. If kept under control

the risks and try to eliminate the too long series of losses, then this tactic

It may be a viable and profitable for small controlled drawdown.

Sometimes - even allow you to display in a profit strategy, which at constant

the size of the deal would be unprofitable.

Expert

Statistic Trader allows

set the size of the lots for a series of ten transactions. The trader has the ability to

adjust the aggressiveness of capital management in its sole discretion, with

I am counting on the fact that knowing the statistics and missed the first losing trades, he

Do not get too long series of actual losses.

Tips for setting up an expert:

- Opt for a currency pair and define its

the average daily volatility. For example, I chose a pair of euro-dollar. its average

day volatility of 70 pips.

- Install Take Profit in the amount of average daily

Volatility (pip 70) and Stop Loss in 2-fold

less (35 pips).

- Testing a strategy on the history of at least

three months. Determined by the average number of consecutive losing trades in such

sizes Take Profit and Stop Loss. For example, it is equal to 3. concludes

that before opening the real deal, it is necessary to wait for three consecutive losses.

Install N = 3

in Expert settings (i.e., skip 3 consecutive loss).

- My approach to capital management -

receive a transaction (a series of transactions) from 0.5 to 1% of the deposit. In case one or

several consecutive losing trades, at least - to play the resulting loss. I

I adjust the size of the lots series as follows:

Step 1: Lot 1, Step 2: Lot 1, third

Step: 2 lots, 4th step: Lot 3, Step 5: 4 lots, 6th step: Lots 6, 7 th step: 9 lots,

Step 8: 9 lots, the 9th step: 9 lots, the 10th step: 9 lots.

Not difficult to calculate that, after receiving

profit on one of the first seven steps, I played obtained before the loss and

I get a small profit. At the same time a drawdown even after 5 consecutive losses will

no more than 4% of the deposit, after 7 consecutive losses - about 9% after 10 -

about 15%. It is no longer, and maybe even less than that of some strategies not

using the increase in the volume of the transaction after the loss. If testing

History has shown that the maximum length of a series of losing trades was 10

and it was only 1 time in a year, then we can hope that, skipping 3-4 loss

in a row, the maximum will still 6-7 losing trades in a row, and the probability of this

It will be very low. Basically, profit is the first or second transaction

after missing several virtual loss.

Another more conservative option:

Step 1: Lot 1, 2nd step: Lot 1, Step 3: Lot 2, Step 4: Lot 3, Step 5: 4

item, the 6th step (starting from the beginning): Lot 1, Step 7: Lot 1, Step 8: 2 Lot 9 minutes

Step: 3 lots, 10-Step: 4 lots. In this case, if losing a series of tightened

than 5 steps, it is possible to let them go back to the original size

capital, but do not lose more than 5%.

trader

the selection parameters can independently determine not only the size of TakeProfit and StopLoss and the throughput of transactions, but also to choose a currency pair and timeframe,

the most appropriate at any given time, as well as set the size of the lots in

series. Between pronounced trend movement or before exiting important

News you can reduce the number of transactions skipped. During the protracted

the flat - increase.

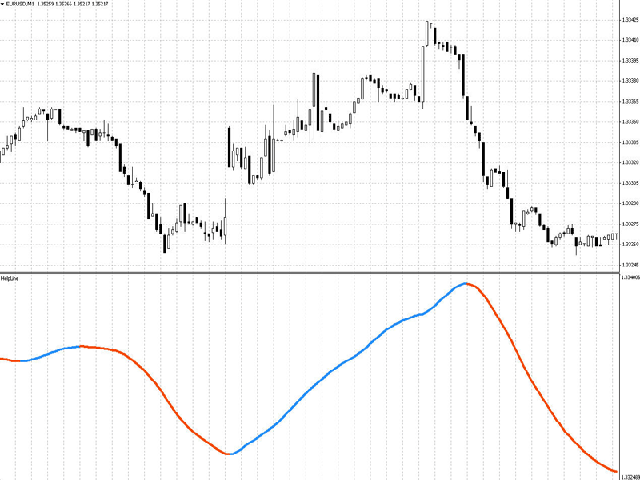

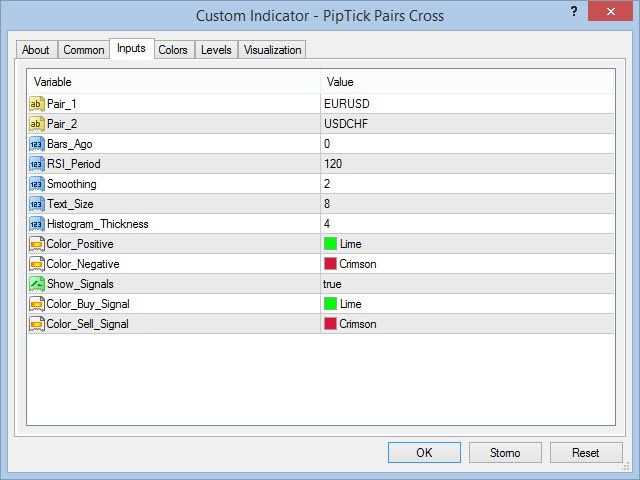

The signals to open positions:

Since this strategy is based on probability, not

It is of fundamental importance for the selection indicator of position opening. I

I opted for the indicator Parabolic SAR, the standard for MT4. signal for the

purchase (LONG)

It is the intersection of the price indicator up signal for short sale (SHORT) - crossing indicator cost down.

closing a position - when the level of Take Profit and Stop Loss.

Yet

I emphasize again: Signal selection for input does not matter, it is

verified by testing all standard and many other indicators that

It showed nearly identical results. The main thing - the ratio of the size of TakeProfit and StopLoss,

which determines the regularity of their occurrence, even with random trading

way.

Features of work:

When you run the expert

It creates a global variable Start, in which the start time is saved

session. At the conclusion of the expert (when achieved profit) is created

global variable Stop. To start a new session after taking profit need

remove from the chart expert and remove the corresponding global variables Start

and Stop (call list of global variables - key F3, or the tab "Tools - Global Variables" in

merchant terminal). With the new launch of the expert will start a new job again

create first Start, then Stop. Such a scheme is implemented for the organization

stable operation in a variety of failures, outages due, and reboots

etc.

Expert

(With different UID and Magic) can be used

on several currency pairs or single, with different settings.

expert settings:

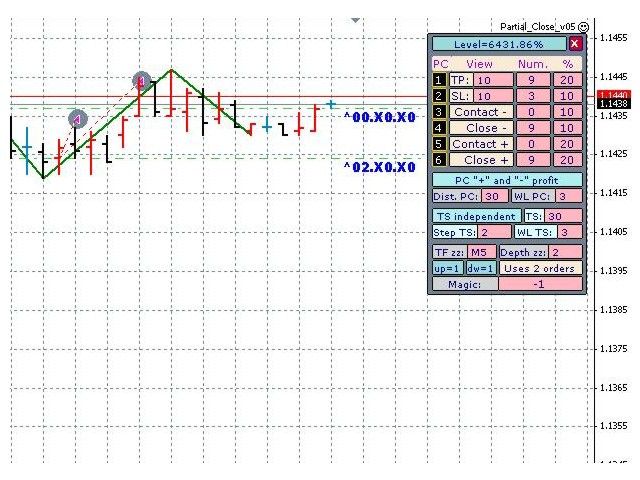

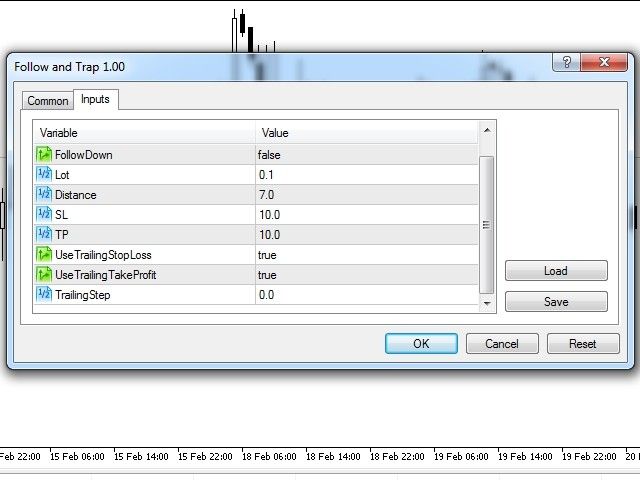

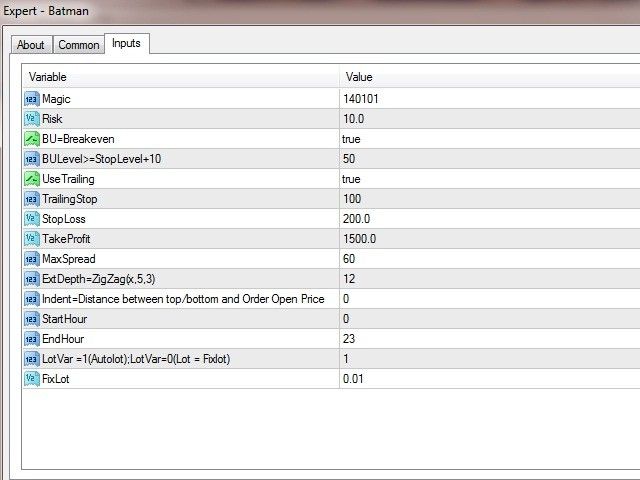

Basic parameters:

- UID = 1

(Unique number of experts to work several experts with different

or settings on different currency pairs UID should be different)

- Magic = 123

(Unique number of orders for a number of experts with different

settings, or in the different currency pairs Magic should be different)

- N = 0 (the number

consecutive losing trades, which will bring the real deal. If N = 0, the first deal is real)

- Lots_1 = 0.1 (volume

1 warrant step lots)

- Lots_2 = 0.2

(Volume of orders in lots 2 steps), etc. for a series of 10 steps

- Lots_3 = 0.3

- Lots_4 = 0.4

- Lots_5 = 0.5

- Lots_6 = 0.6

- Lots_7 = 0.7

- Lots_8 = 0.8

- Lots_9 = 0.9

- Lots_10 = 1.0

- Slippage_ = 3 (max

deviation from quoted price at opening and closing market positions)

- SL_ = 35 (StopLoss in pips)

- TP_ = 70 (Take

Profit in pips)

- OpeningTwoSendings = true (true - setting StopLoss and Take Profit for market orders made after opening a position, false - immediately when opening a position)

- DigitsModify = true (change point for the normalization work on

quotations with 5 or 3 characters after the decimal point)

Parabolic SAR parameters:

- ParabolicTF = 60 (the period

the indicator chart, ie timeframe)

- ParabolicStep = 0.02 (increment

Stop indicator level)

- ParabolicMaximum = 0.2 (maximum

Stop indicator level)

General parameters:

- Alerts = false (true / false - or not to display messages on trade

operations)

- Comments = true (true / false - whether or not to comment when dealing with

the trade server)

- Sounds = true (true / false - or not to output audio signals when

trade operations)

- Visualization = true (true / false - or not to carry out imaging trade

Operations on the graph)

Related posts

Easy Trader EA

Easy Trader EA Robot Day Trading Easy Trader EA This EA is designed to trade a couple USDCHF on the chart H1 . In fact, it is not profitable to any other...

Robust Trader 20 EAs

Robust Trader 20 EAs 9 most terrible secrets of scalpers who make you lose money Scalper tested under ideal spreads, i.e. 0.5 or 1.0 pips? Your broker...

NewsSpeed

NewsSpeed News Speed Advisor written for EURUSD M1 trading on news output, changing the settings can be probyvat other currency pairs and time periods...

Next posts